1 Big Winner From Hong Kong’s Stock Listings

When China’s dominant e-commerce giant Alibaba Group Holding Ltd (NYSE: BABA) (SEHK: 9988) listed in New York back in 2014, it was a blow to the Hong Kong stock market.

More specifically, it was a setback for the operator of the exchange; Hong Kong Exchanges and Clearing Ltd (SEHK: 388), also known as HKEX.

The sole operator of Hong Kong’s huge stock market, regulations in Hong Kong that forbade dual-class shareholders were seen as one of the key reasons why Alibaba went with New York over Hong Kong.

Fast forward to today and the picture is a lot different. Alibaba is now listed in Hong Kong, having carried out a secondary offering in late 2019.

With Ant Group’s upcoming blockbuster IPO in both Shanghai and Hong Kong making a lot of noise, it got me thinking about the larger trend of Chinese companies (that are listed in the US) carrying out secondary listings in Hong Kong.

What does it mean for investors and how did we get to this point?

Returning home

Previously for Chinese companies, it’s been obvious why US stock markets were chosen in the golden age of globalisation.

Stock markets in the US offer companies much deeper liquidity, a more professional investor base and a broad acceptance of preferential shareholder structures (particularly important for tech firms).

Losing out to New York on Alibaba’s listing spurred the Hong Kong Stock Exchange into action. In early 2018, amendments were made to ensure that listings that involved dual-class shares – also known as “weighted voting rights” – would be permitted.

It was great timing because that was the year President Trump in the US started ratcheting up pressure on China on the trade front. Since then, it has morphed into wider uncertainty for Chinese companies, especially for those listed on US stock markets.

We’re all familiar with the tensions since then but what Alibaba’s listing in Hong Kong signalled was actually the start of a bigger trend of US-listed Chinese companies looking to list shares in Hong Kong. That’s just the start of a trend that’s expected to pick up pace (see below).

Secondary offerings on the Hong Kong Stock Exchange over past 12 months

|

Company |

Stock code | Date listed | Amount raised (US$ billion) | Market cap (US$ billion) |

|

Alibaba Group |

9988 | November 2019 | 12.9 | 753 |

|

NetEase Group |

9999 | June 2020 | 2.7 |

65 |

| JD.com | 9613 | June 2020 | 3.9 |

115 |

| Yum China | 9987 | September 2020 | 2.2 |

22 |

Source: Bloomberg, Yahoo Finance

In addition to the ones already “returning home”, there are a slew of other secondary offerings from US-listed Chinese firms slated to come to market this year and next.

Buying Chinese

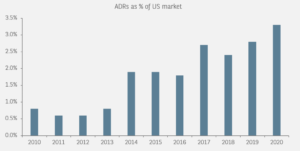

So, what are investors to do? Well, it’s clearly cast a cloud over around US$1 trillion worth of Chinese, US-listed American Depositary Receipts (ADRs). Furthermore, Chinese ADRs make up a not so insignificant 3% of the total market cap in the US (see chart below).

Source: Goldman Sachs as of June 2020

Around 233 Chinese companies are listed in the US via ADRs and the interest in listing shares in Hong Kong is a sign of the increasing corporate unease with the US administration.

Furthermore, the US government has made noises about stepping up the scrutiny of audits of Chinese companies listed on the New York Stock Exchange and Nasdaq.

Back in May of this year, President Trump ordered the US federal government retirement fund to halt plans to shift some of its money into Chinese companies.

Then in August, the US State Department asked American colleges and universities to divest their holdings of Chinese companies that amount to more than US$600 billion in endowments.

That was part of a warning to them on the potential “wholesale delisting” of Chinese companies by the end of 2021 if they didn’t meet new rules surrounding transparency over accounting.

To me, some of this is probably political hyperbole. It would have to take a massive deterioration in US-China relations for a “nuclear option” that included wholesale delistings of Chinese companies.

Yet that hasn’t stopped the likes of Temasek switching out of Alibaba’s ADRs and into its Hong Kong-listed shares.

In late August, it was revealed that the Singapore asset manager was just one of a number of institutional investors that had swapped Alibaba’s US-listed shares for the Hong Kong ones.

The lesson? If you’re thinking about buying Chinese shares that have a dual US/Hong Kong listing then it makes more sense to invest in the Hong Kong shares given the geopolitical uncertainty.

HKEX a big winner

You’d think there wouldn’t be any winners from the cold shoulder the US is giving Chinese companies. But HKEX is making hay from the “coming home” trend of Chinese firms.

It’s easy to see why. Listing fees, higher turnover and more market breadth should bolster Hong Kong’s status as a stock market trading hub – particularly for international investors who want to tap China’s high-growth companies.

Luring companies to list in Hong Kong and linking them up to China’s vast capital markets and investors via the Stock Connect scheme has been a winning strategy for the operator.

Grand plans to develop an integrated Greater Bay Area – that includes Shenzhen and Guangzhou, as well as Hong Kong and Macau – will help bolster its appeal as a listing destination for regionally-based companies from places such as ASEAN.

The deep liquidity and access to capital markets found in Hong Kong gives HKEX a unique competitive advantage over, say a Tokyo (where the market is much more domestically-focused) or Singapore (which is far too small in terms of market liquidity).

Focus on larger trends

As long-term investors, we should always be trying to navigate the landscape. Generally, geopolitics hasn’t played a major part in stock market returns.

That’s now changing, though. Investors should react accordingly given the rising US-China tensions. Just because there are risks from the shifting landscape, though, it doesn’t mean there won’t be opportunities along the way for those of us willing to think long term.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.