3 Stocks to Buy in China’s Greater Bay Area

China’s Greater Bay Area, also dubbed “GBA”, has been making headlines recently. President Xi Jinping visited Shenzhen to give a talk on the development of the GBA.

The aim it to position it as a global rival to “bay area” metropolitan centres of innovation and finance like Silicon Valley or Tokyo.

On the whole, investors should be wary of grand themes and stories of “liberalisation” that the Chinese government touts. That’s because they’re not usually backed up by concrete action.

However, the geopolitical situation has drastically changed over the past few years. A more aggressive China policy by President Trump and politicians in Washington has forced Beijing to accelerate its efforts at building up its own innovation and technology.

Chinese growth engine

The GBA is going to be the centerpiece of that effort by China. Encompassing Guangdong province along with Hong Kong and Macau, the combined Greater Bay Area has 71 million people.

Perhaps even more crucially, the area has less than 1% of China’s land mass but contributes around 12% of its GDP. Clearly, it has had an outsized influence on China’s extraordinary economic development.

With that, here are three stocks listed in Hong Kong that could be key beneficiaries of the GBA plan by the Chinese government.

1. Ping An Insurance

Leading Chinese insurer Ping An Insurance Group Co of China Ltd (SEHK: 2318) is one of China’s largest financial services firms.

It’s mainly involved in insurance – life, health, and property & casualty (P&C) – but has banking, asset management and health tech under its umbrella too.

Ping An Insurance is also headquartered in Shenzhen, one of the key cities within the Greater Bay Area. President Xi Jinping actually singled it out in one of his latest blueprints for the GBA – identifying the Shenzhen special economic zone as an “important core engine” of the initiative.

Beyond that, Ping An is one of the most well-run insurance companies in the country. What makes the insurance heavyweight so special is the unique way it leverages technology to make financial services more efficient.

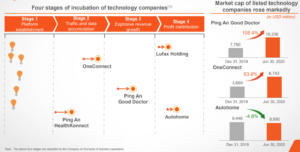

Ping An also has a strong track record of developing technology subsidiaries that eventually go on to list on stock markets in both Hong Kong and the US (see below).

Source: Ping An Insurance’s first-half 2020 results presentation

Its latest first-half results testify to the resilience of the business. For the first six months of 2020, when Covid-19 had hammered the Chinese economy early in the year, Ping An still managed to eke out a 1.2% year-on-year rise in operating profit to RMB 74.3 billion (US$11.1 billion).

According to DBS, Ping An Insurance generates 18% of its overall insurance premiums from Guandong province. This is the highest percentage of all China insurers and is well ahead of second-placed China Life Insurance Co Ltd’s (SEHK: 2628) 9% share from Guangdong.

With a strong working relationship with local governments in the region, and an extensive nationwide presence, Ping An Insurance is set to benefit from the GBA for the foreseeable future.

2. Café de Coral

Anyone who’s dined at fast-casual restaurants in Hong Kong will no doubt be familiar with Café de Coral Holdings Ltd (SEHK: 341). The company owns and operates 450 quick-service restaurants in Hong Kong and Mainland China.

It has its eponymous flagship Café de Coral brand as well as other casual dining chains such as The Spaghetti House and Oliver’s Super Sandwiches. Café de Coral also has an institutional catering business that serves clients such as hospitals, universities and other corporations.

Although the company only derives around 15% of its revenue from Mainland China, nearly all of this comes from Guangdong province.

Despite its overall business taking a huge hit from Covid-19 and the Hong Kong protests, its China business was a relative bright spot. Café de Coral has an exclusive focus on the Guangdong region.

For Café de Coral’s fiscal year 2020 (for the 12 months ending 31 March 2020), the group saw a 6.2% year-on-year drop in revenue.

However, the firm’s China business only saw a 1.5% year-on-year fall in revenue due to the impact of Covid-19 early in the year.

Although the company’s operations will take time to full recover from the Covid-19 pandemic, the fact that Café de Coral has an established presence in Southern China – with around 114 outlets – means the company is well-positioned to take advantage of rising incomes in the GBA.

3. BYD Co

Investors may be unaware that BYD Co Ltd (SEHK: 1211) – which stands for “Build Your Dreams” – is actually one of the world’s largest producers of electric vehicles (EVs) as well as electric batteries for cars.

Its two subsidiaries – BYD Automobile and BYD Electronic – represent these two businesses. In fact, Warren Buffett’s Berkshire Hathaway Inc (NYSE: BRK.B) has a 25% stake in BYD, which it had acquired all the way back in 2008.

Also headquartered in Shenzhen, BYD is a one of the best ways for investors to bet on the electrification of China’s automobile industry.

Better yet, the company also has exposure to both big themes; EVs themselves and the batteries that will power the future EVs of other auto brands.

It has established a joint venture with auto giant Toyota Motor Corp (TYO: 7203) in order for BYD to provide the Japanese auto giant with battery capabilities for EVs.

It’s a fiercely competitive space in EVs. Yet the GBA will give BYD the opportunity to make headway in its home province given the relative affluence of the population there versus the rest of China.

This spells good news for the development of EVs – which the Chinese government is already trying to promote – as the GBA initiative drives the transition towards more sustainable modes of transport.

A year-long downturn in China’s new energy vehicles market looks to be finally turning a corner, too. In August, the sales of EVs and hybrids in China rose 45% year-on-year as the pace of growth rebounds from the fallout of Covid-19 and reduced subsidies.

For long-term investors who want to ride the growth of the GBA (as well as from EVs) then BYD seems like a solid choice.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Ping An Insurance Group Co of China Ltd.