FAQ

Go to My Account → Manage Funds → Deposit.

ProsperUs offers the following funding methods:

| Funding Method | Time Taken for Processing |

| PayNow QR | Processed instantly (Recommended) |

| PayNow UEN | Processed within the same business day for any transactions done before 5pm, Singapore Time (SGT) |

| FAST | Processed within the same business day for any transactions done before 5pm, Singapore Time (SGT) |

| Telegraphic Transfer | Processed within 2-3 business days |

PayNow QR Guide on mobile devices

- To initiate a PayNow QR transaction on your mobile device, submit a funding request.

- Save an image of the QR code on your mobile device.

- After saving the QR code image, proceed to your internet banking app to start the PayNow QR code transaction.

- Select to upload the QR code image from your photo album/gallery in your banking app.

Note: The QR code is unique to each transaction and it expires in 5 minutes.

PayNow UEN, FAST & Telegraphic Transfer (TT) Guide

A deposit request is necessary for all types of deposits. e.g. PayNow, FAST and TT.

In the deposit request, you can find relevant information to initiate a transfer from your bank.

To facilitate your deposit, ensure the relevant information is completed and submit your deposit request in ProsperUs.

Note: ProsperUs do not accept funding from DBS PayLah!, Google Pay, and any other 3rd party applications funding.

You can fund your account with any currency. Any funding conversion is subjected to the bank’s exchange rate.

| Payment Method | SGD |

|

|

| PayNow QR | 🗸 | ✕ | |

| PayNow UEN | 🗸 | ✕ | |

| FAST | 🗸 | ✕ | |

| Telegraphic Transfer (TT) | 🗸 | 🗸 |

#TT charges and conversion rates of different currencies will be subjected to the banks.

All withdrawal will be credited to the verified bank account(s) submitted. To initiate a withdrawal request, My Account → Manage Funds → Withdraw.

Note: Ensure that you are not withdrawing funds that are pending for settlement. Settlement of trades takes 1-2 business days.

You are required to submit a bank statement within the last 3 months displaying your bank name, personal name, and bank account number explicitly. Verification of bank accounts will take 1 business day.

To add a bank account, go to My Account → Manage Funds → Add bank account.

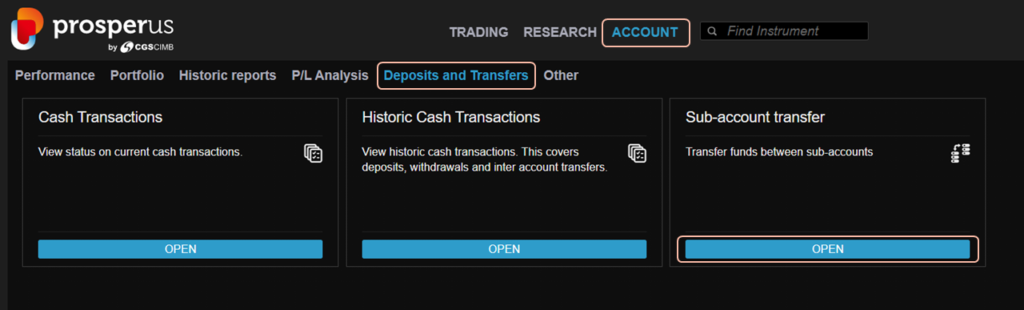

To initiate an intra-account transfer of funds between your currency accounts, go to BOOST, under Account → Deposits and Transfers → Sub-account Transfer.

This will be subjected to prevailing FX rates.

We are unable to verify your transaction and will proceed with the rejection of funds. Please note that we do not accept 3rd party funding and 3rd party application funding.

Any rejection of funds will take at least 1 month for the funds to be credited back into your originating bank account.

Do note that we do not accept any 3rd party funding and 3rd party application funding. Funds are subjected to rejection and may take at least 1 month to be credited back to your account.

Some examples why you may have a negative balance in your currency account:

- You have withdrawn receivable funds that are pending for settlement. Funds from your sales transaction will be available on the settlement date. This will take up to 3 business days from the transaction date, depending on the respective exchanges. Withdrawal of funds that have not been settled will incur financing charges, given that we are required to borrow capital to finance your early withdrawal.

- If you have multiple currency accounts and have sufficient funds in your overall account, you have to ensure that the currency account you have used to execute a trade has sufficient cash balance, or else you will incur financing charges. In the scenario that you have performed a trade without sufficient cash balance, check your balances after 2pm and top up your account accordingly.

- If you purchased a leveraged product on a currency account that has insufficient funds to cover your unrealised losses and maintain your margin, it will result in a negative balance and you will incur financing charges.

For the interest breakdown, please view the ‘Interest Detail’ report under Account.

*Note: If you have a negative balance due to point 3, it will reflect in your other multi currency accounts as well. Please top up the currency account used to execute in order to minimise financing charges incurred.