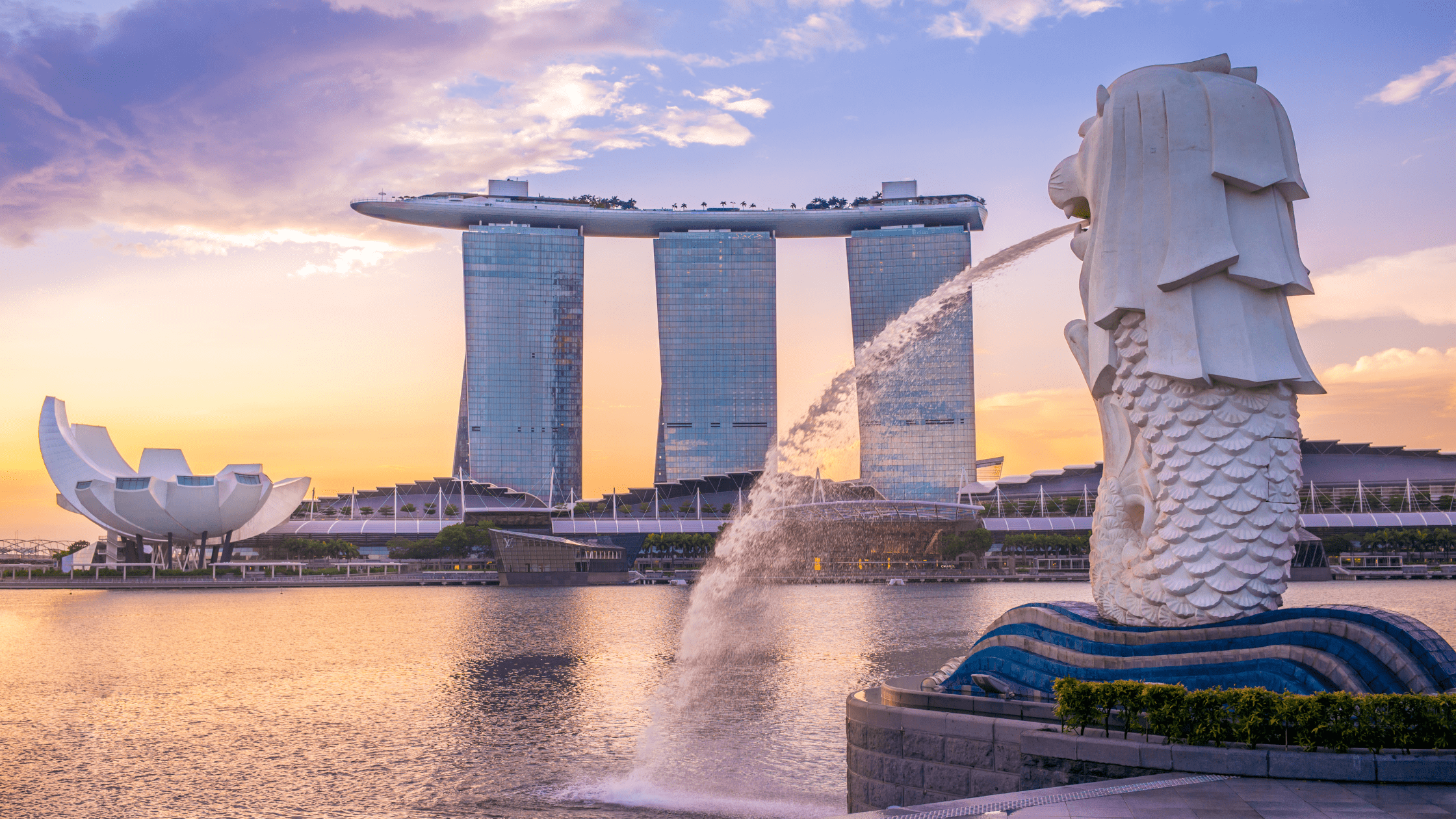

Chart of the Week: DBS Leads Singapore Bank Stocks Higher

Singapore stocks had an eventful November as news of a number of successful Covid-19 vaccines spurred a strong rally in the local market.

In Singapore, the relief rally was particularly welcome. A number of the companies listed here have been hit hard by the global pandemic given how open the Singapore economy is to both travel and trade.

Yet it’s also because Singapore’s Straits Times Index (STI) is dominated by more traditional companies such as banks, property developers and travel-related firms.

DBS a big winner among banks

Besides the usual STI suspects you’d expect to benefit – think SATS Ltd (SGX: S58) and Singapore Airlines Ltd (SGX: C6L) – one of the bigger sectors that saw an uplift was banks.

Unsurprisingly, this was led by DBS Group Holdings Ltd (SGX: D05). Singapore’s biggest bank was up an impressive 27% in November (see chart below) while it also turned positive on a year-to-date basis as well.

That was in stark contrast to some of the month’s big winners, which still sit below where they started 2020.

Furthermore, professional investors seem to think DBS is worth holding on to given the massive net inflows in November.

What explains the disparity between DBS and the other two of United Overseas Bank Ltd (SGX: U11), known as UOB, and Oversea-Chinese Banking Corporation Limited (SGX: O39), known as OCBC?

China and wealth

Mainly, it was down to earnings and guidance. All three banks reported around the beginning of November but DBS surprised positively by reporting lower loan loss provisions than expected.

However, one rarely-mentioned aspect is that DBS derives a larger proportion of its business and profits from China and Hong Kong.

That was considered a negative point a few years ago as the Chinese economy slowed. But as the world’s second-largest economy is now one of the best-performing large economies in the age of Covid-19, it is likely to become a tailwind for DBS.

Another area of optimism is wealth management, which is a big business focus for DBS and where it’s catching up fast with local leader OCBC (in terms of fee income).

Even though OCBC seems to be offered up by analysts as the most appealing Singapore bank on a valuation basis, I’ve always adhered to “buying the leader” and “paying up for long-term quality”. And that’s exactly what you’ll get with DBS.

Source: SGX as of 30 November 2020

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of DBS Group Holdings Ltd.