Chart of the Week: Lyft Shows Why Ridesharing is Bad Business

It’s no secret that the big two ride-hailing companies in the US, Lyft Inc (NASDAQ: LYFT) and Uber Technologies Inc (NYSE: UBER) have been bleeding red ink for a while.

What’s more surprising is the tear Lyft shares have been on over the past few months – since the end of October Lyft’s share price is up 150%. Shares popped 10% at the open yesterday in reaction to the news of its latest results.

A lot of this boost can be attributed to news of a Covid-19 vaccine late last year. Yet, as its latest results show, not much has changed on the ground (or in the car) with Lyft’s business.

As I’ve written about previously, Lyft and Uber have seen their numbers of total rides plummet amid the Covid-19-induced lockdowns globally.

Yet, at least Uber has the strength of its food delivery business to cushion the blow. Lyft, meanwhile, is all-in on ride-hailing – a notoriously unprofitable business.

Huge losses…and a rising share price

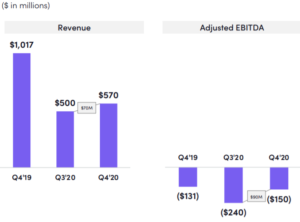

While Lyft’s latest fourth-quarter earnings did see a slight improvement in revenue sequentially and its adjusted loss narrowed (see below), it should be taken in the context of overall 2020 numbers.

On this front, it’s astounding. Lyft saw revenue decline to US$2.36 billion in 2020 from US$3.61 billion in 2019. Its operating loss in 2020 was US$1.8 billion versus a US$2.7 billion loss in 2019.

Yes, losses narrowed but this should be taken in context. Overall costs have also been slashed in 2020, falling around 35% versus 2019 while spend on sales and marketing last year was cut by 50%.

Growth companies with a large total addressable market (TAM) and exciting sales growth figures tend to be rewarded by shareholders – with the caveat that the company has a path to profitability.

Lyft may have a large TAM but its underwhelming growth rates (along with no clear path to scaling profitably) mean that long-term investors should be staying well clear of this ride.

Source: Lyft Q4 2020 earnings presentation

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.