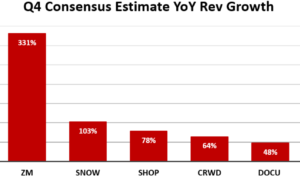

Chart of the Week: High Expectations for SaaS Stocks

Software-as-a-Service (SaaS) stocks in the US had an extraordinary 2020 amid the global Covid-19 pandemic. Why was that the case?

Simply put, their services became even more necessary during lockdowns and as the work-from-home trend became the norm.

Names such as Zoom Video Communications (NASDAQ: ZM) and recently-listed Snowflake Inc (NYSE: SNOW) have seen revenue expectations from analysts soar (see below).

Perhaps it’s par for the course that high growth goes hand-in-hand with these kinds of stocks going into the latest earnings season.

For example, in its latest earnings release, Zoom upgraded its fourth-quarter fiscal 2021 revenue guidance to US$806-811 million.

Clearly, Zoom has been an exception given how critical its video-conferencing services has been. But what about the other SaaS stocks that have been darlings of investors of 2020?

The likes of Shopify Inc (NYSE: SHOP) in e-commerce, Crowdstrike Holdings Inc (NASDAQ: CRWD) in cybersecurity and DocuSign Inc (NASDAQ: DOCU) in digital agreements have all benefitted.

Can they continue to meet, beat and raise the bar on elevated expectations from analysts? That’ll be a key question for investors as we head into earnings season.

Source: @Beth_Kindig, Twitter

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Zoom Video Communications Inc, Shopify Inc, Crowdstrike Holdings Inc and DocuSign Inc.