3 Reasons REITs Beat Property as an Investment

In Singapore, a common refrain you hear when it comes to buying a property is that “you should buy a property if you’re going to live in it”. We should know. Singapore has one of the highest home ownership rates in the world.

I don’t think many of us would disagree with that sentiment but when it comes to investing and building up a passive stream of income for ourselves, is bricks-and-mortar actually better than the other property alternative – real estate investment trusts (REITs)?

For a number of reasons, I would say no. Here’s why REITs make more sense for those of us who want to invest in property as a means of creating reliable dividend income for the future.

1. Tax-free income

In Singapore, dividends paid out by REITs are completely tax-free. That’s right. You pay 0% on all the income you get from REITs, so if you rake in S$5,000 in dividends per year you get to keep the whole lot.

But say a property you’ve purchased as an investment gives you the equivalent S$5,000 in rental income per year, you would be subject to income tax at the normal personal tax rate.

In effect, you would be handing over a sizeable chunk of that valuable income stream to the Inland Revenue Authority of Singapore (IRAS).

2. Falling local yields

Additionally, rental yields in Singapore currently are, in my opinion, poor relative to the REIT market.

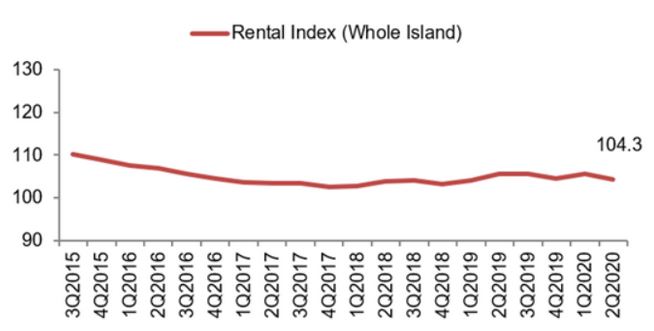

Just look at the rental index in Singapore (below) over the past five years and you can start to understand why physical property hasn’t been worth investing in as an income source.

You’re not looking at receiving anything higher than a 2.5-3% yield – if you’re lucky – on a property investment.

Singapore rental index 2015-2020

Source: Urban Redevelopment Authority (URA) as of Q2 2020

And remember that the yield is in fact even lower because of the tax you have to pay from the rental income, plus don’t forget about all those pesky management fees.

Right here in Singapore, we have a lot of listed REITs that trade publicly. They operate in various sectors, from the industrial to commercial to retail and they also offer you solid payouts.

For example, Mapletree Industrial Trust (SGX: ME8U) – an industrial REIT that has over 100 properties in Singapore, the US and Canada – currently gives investors a reliable forward yield of 3.6%.

Not only that but REITs offer you the chance to own a piece of multiple properties that are professionally managed. This comes without the need for a huge outlay of capital that accompanies down payments on property.

3. Liquidity

One thing that a lot of investors don’t discuss is the liquidity of an investment; essentially how easy it is to buy or sell what you own.

A property is far from easy to purchase or sell in a timely manner. You need to draw up contracts, find a surveyor, most likely secure a housing loan and complete the transaction, all of which added together can take months.

As an investment that’s not ideal. If you own a property and want to sell it (if you need cash in a pinch), it will be far from easy.

Meanwhile, by purchasing a REIT you own those units within two business days and selling it is the same – you’ll receive your cash in days and not months.

REITs for long-term income

Overall, if you’re an investor who wants to build up wealth in the long term from property then REITs are the clear answer in the current environment.

The multiple advantages the asset class has over bricks-and-mortar as, and I stress this, an investment means that those of us looking to create reliable income streams from property in the future should look no further than the REIT market.