What Are Mutual Funds?

Mutual funds, also known as unit trusts, are a type of investment vehicle that let’s investors access a basket of securities.

These tend to be stocks or bonds but can include harder-to-access assets such as property. They’re very similar to ETFs but with some key differences.

One such difference is that mutual funds are not listed on any stock exchanges. In that respect they are open-ended funds.

What this means is that mutual funds are collective investment schemes that pool investors’ money together.

It also allows the mutual fund manager to issue unlimited shares if they wish (unlike listed stocks or ETFs where there are a finite amount of shares issued).

As a result, unit prices of mutual funds are determined just once a day so investors won’t know what price they have bought/sold at until the following day.

1. Trying to beat the market

One of the main features of mutual funds is that they are actively-managed funds, unlike an ETF, which tends to be a passively-managed fund.

If a fund is actively-managed, it means that the fund manager that runs it is trying to beat the returns that the overall market (for example, the S&P 500) generates.

There are thousands of mutual funds in the market. The majority are provided by large asset managers such as Fidelity, BlackRock, Manulife, Schroders, JP Morgan and HSBC.

Given there is a basket of stocks in these funds, they tend to deviate somewhat from what the index is made up of. By doing this, the fund managers hope to outperform (essentially beat) the returns that investing in a market-tracking ETF would give you.

2. How can I benefit from investing in mutual funds?

If you have belief in a certain fund house or, in particular fund manager, to deliver returns that can beat the market then mutual funds provide one avenue for investors to achieve market-beating returns.

Mutual funds also allow you to diversify by sector (similar to ETFs) but, perhaps most importantly, by geography.

That’s because many fund providers operate mutual funds that focus on a specific market, such as Indonesia, Thailand or India. This allows investors to access a broad basket of stocks/bonds in these markets.

However, there are some disadvantages to mutual funds as well that all investors should be aware of:

- Mutual funds charge administrative fees that can build up over time. For example, nearly all fund providers will charge investors an annual management fee on your total invested amount merely for holding their units. This can be reflected in an “expense ratio” of the fund, which is in essence the amount in fees taken to run the fund (usually displayed as a percentage figure).

- If a successful fund manager departs from a fund provider, there is no guarantee that their replacement will be able to replicate the market-beating returns.

- Given mutual funds are open-ended funds, in times of extreme market volatility, there can be a wide gap between its net asset value (NAV) – essentially its price – versus the redemptions it faces. This can force the fund to sell assets off at an even faster pace (at possibly the worst time) to meet investor redemptions.

3. How do I invest in mutual funds?

Investing in mutual funds in Singapore is easy. You can access a wide selection of funds from banks’ investment platforms.

Doing all this online has become easy. What’s more, you can invest in a mutual fund with as little as $100 per month. It can be a good way to slowly invest into the market via dollar cost averaging (DCA).

Alternatively, you buy funds directly via an easy-to-use and accessible brokerage account, which you can do with CGS-CIMB right here.

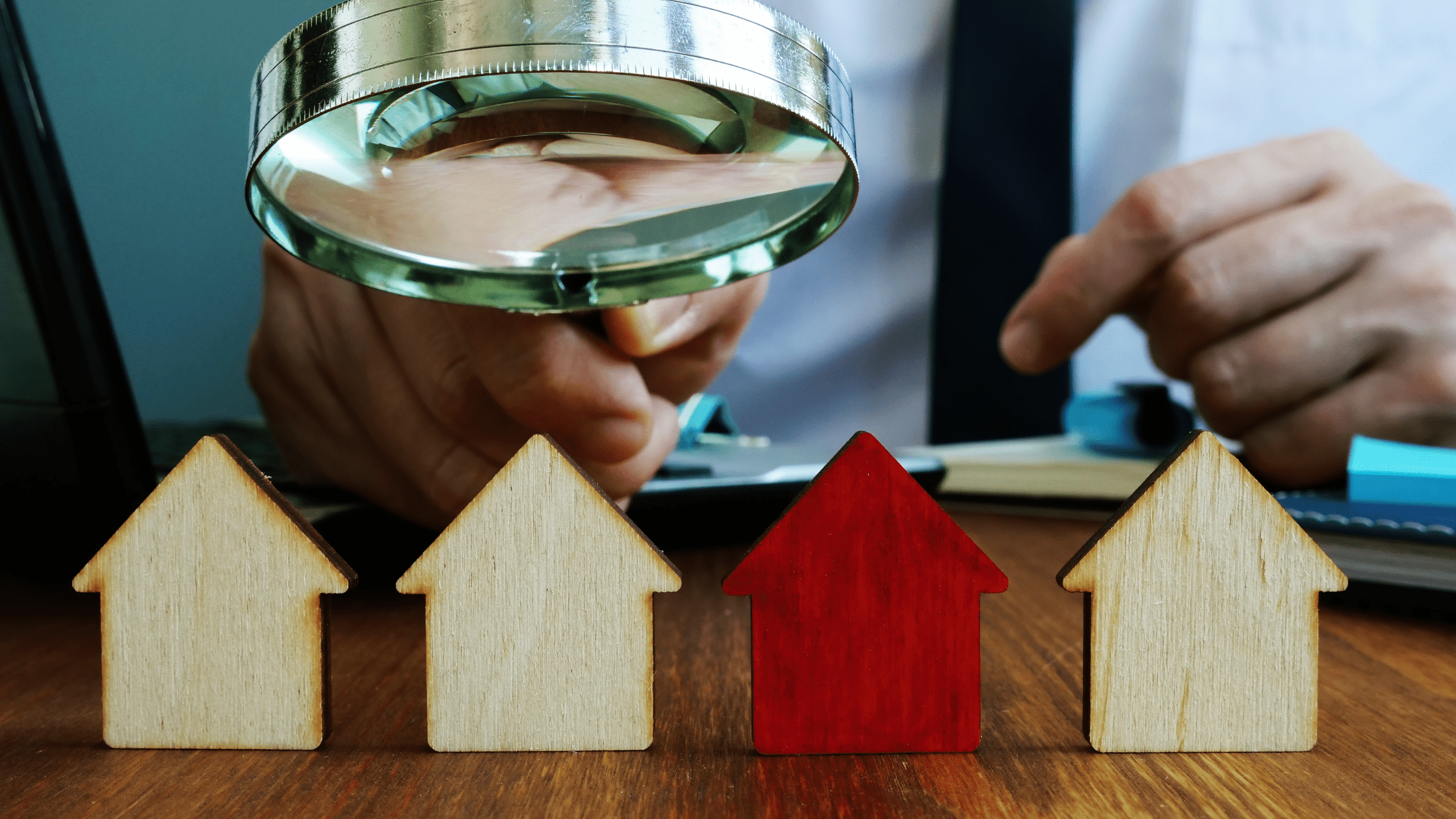

4. How do I choose mutual funds?

Like ETFs, there are hundreds (if not thousands) of mutual funds that investors can choose from.

What’s important to remember is that mutual funds tend to be actively-managed so that means the investment team behind the fund is important given their influence on the returns that are generated.

Although past performance isn’t a guarantee of future returns, it’s definitely a good indicator for us to take note of.

Looking out for funds that have consistently performed well over longer stretches of time is also important.

Some funds may outperform the market over one year but over five years, say, it doesn’t beat an index’s returns.

Taking a look at the individual components of a fund is also important. Some funds can be very concentrated in a few sectors while others may be extremely diversified, with many holdings.

At the end of the day, it’s up to your own individual preferences in understanding which funds you’ll be comfortable investing in.

Finally, investors should try to work out the returns they will be given after including the fees that are taken. This is vital as it will help you determine whether the fund is beating a regular index fund.