Why Should I Buy Singapore Stocks?

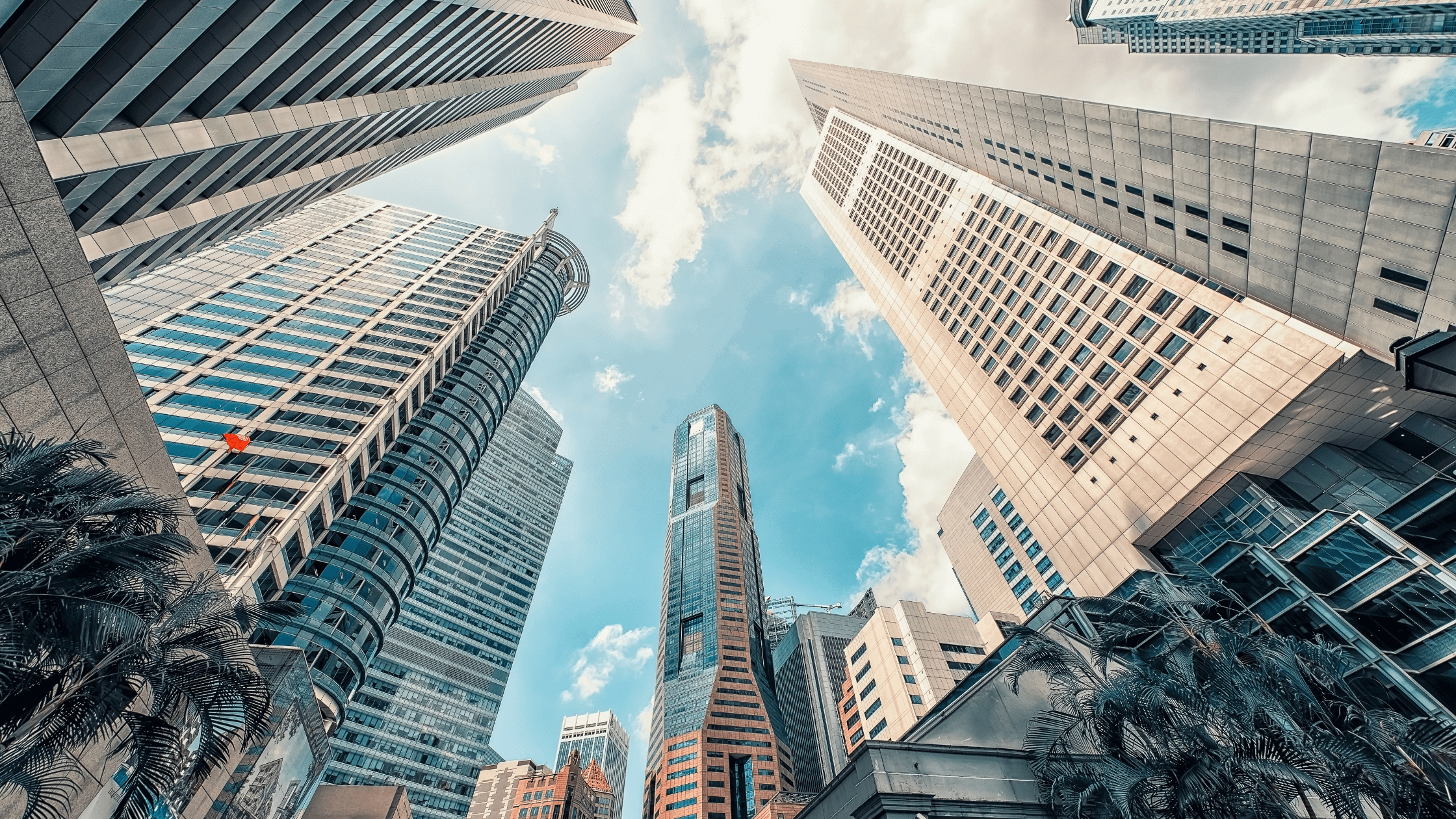

Singapore, as a country, is relatively young. However, the progress that it has made since becoming independent, back in 1965, is astounding.

As the regional financial centre competitor to Hong Kong, Singapore has always been a place that attracts both capital and talent.

That has allowed investors here in Singapore (and those abroad) to take advantage of the local stock market.

As investors, we should always look to invest in three key markets; our home market – in this case Singapore – as well as the US and China.

Investing in companies we’re familiar with is a great first step to build up our wealth, especially for those of us who are new to investing.

Looking at companies such as Singapore Telecommunications Limited (SGX: Z74), or Singtel, or DBS Group Holding Ltd (SGX: D05), these are companies that we are all familiar with.

Already understanding how these businesses work puts us in a better position to take that first step towards successful long-term investing.

Overview of Singapore stock market

The Singapore stock market is normally associated with the large benchmark index – Straits Times Index (STI).

The STI has a history dating back to 1966, just after independence, when the Straits Times Industrial Index represented the bulk of the Singapore stock exchange.

However, after a reclassification in 1998, the STI was born. The index has 30 of the largest Singapore-listed companies, by market capitalisation.

It’s generally regarded as a great place for investors to “invest for yield”, which of course means dividend stocks.

Having built a reputation for more mature, reliable and cash-generating businesses, Singapore stocks therefore offer investors a dependable route for passive income generation.

For many professional fund managers who invest in the region, Singapore’s market is viewed as a broadly “safe” spot to park money in dividend-paying stocks.

Growth and dividend growth stocks tend to be a rarer commodity given Singapore’s small total stock market size and the relatively low turnover/market liquidity – versus say the US or Hong Kong markets.

Market sectors

In Singapore, it’s no surprise that the companies we are all familiar with dominate the benchmark STI.

Much of the stock market today in Singapore is made up of banks, real estate investment trusts (REITs), property developers and industrial firms.

Given these are the biggest companies in Singapore, they are all relatively mature and slower-growing than, for example, technology or healthcare stocks in the US or Hong Kong.

On the flip side, they do provide reliable dividends. For example, REITs are one of the most popular places for investors in Singapore.

That’s because they offer you a very affordable route to invest in multiple properties in different segments (whether that be in the retail, industrials, logistics, healthcare or hospitality space).

In return, you will receive a regular payout from REITs in the form of “distributions” – which is basically another word for dividends.

As with all other indices, the Straits Times Index carries out a regular review of when to include a new company in the index, as well as which current company it will replace.

In the table below of the top 10 stocks in Singapore’s STI, you can see that banks have a very big weighting in the index. The “big three” banks of DBS, OCBC and UOB make up over one-third of the STI.

Top 10 Singapore stocks by Straits Times Index weighting

| Stock | Weighting (%) | Stock | Weighting (%) |

| 1. DBS Group Holdings Ltd (SGX: D05) | 15.9 | 6. Ascendas REIT (SGX: A17) | 3.9 |

| 2. Oversea-Chinese Banking Corp (SGX: O39) | 10.9 | 7. Singapore Exchange (SGX: S68) | 3.7 |

| 3. United Overseas Bank (SGX: U11) | 9.7 | 8. CapitaLand Limited (SGX: C31) | 3.5 |

| 4. Singtel (SGX: Z74) | 7.5 | 9. Wilmar International (SGX: F34) | 3.4 |

| 5. Jardine Matheson Holdings (SGX: J36) | 4.8 | 10. Keppel Corporation (SGX: BN4) | 3.4 |

Source: sginvestors.io, as of 28 August 2020

What are the biggest companies?

As just discussed, the biggest companies are the Singapore banks. They tend to be highly cash-generative and sturdy businesses that also pay out reliable dividends.

However, it’s worth noting that this year (during the pandemic) they were forced by the Monetary Authority of Singapore (MAS) to cap their dividends at 60% of the levels they paid out in 2019.

Even though none of them were in a financially-precarious position, this is likely to be a temporary headwind for the banks given the extraordinary circumstances of Covid-19.

After banks, you then have the largest telecommunications provider in Singapore, Singtel. Again, the company has been a reliable dividend payer over the years but recently has had to cut its dividend due to operational headwinds.

As investors, it’s an example of the fact that dividends (and their sustainability) need to be monitored – even for the biggest companies.

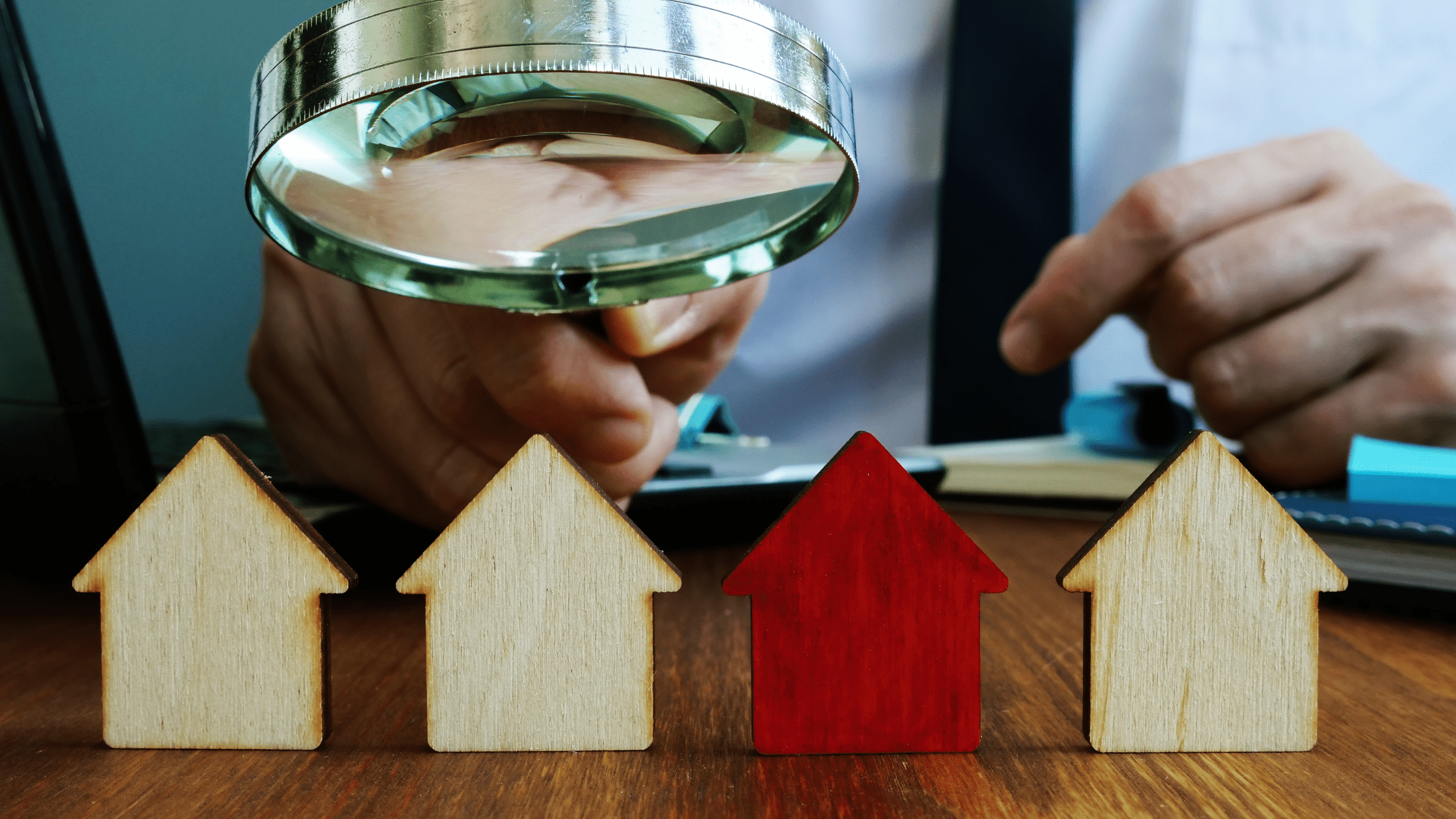

More recently, REITs have taken centre stage as investors search for reliable income. In that sense, there are some REITs that have delivered steady or rising distributions (even amid the Covid-19 pandemic).

Generally, REITs have been preferred investments over the past few years versus property developers such as CapitaLand Limited (SGX: C31) or City Developments Limited (SGX: C09), also known as CDL.

That’s because property developers don’t have dividends that are attractive and their revenues and income are less predictable given they are mainly tied to the residential property market.