5 Reasons Why Dividends Are Important When Investing

If I said that you could get “free” money simply by owning some stocks, would that surprise you?

Effectively, that is what dividends are. Merely for owning a piece of a company and holding shares in it, management also shares the firm’s profits with you by paying out dividends.

Many individuals starting out might not realise that buying stocks is not always about only increasing the value of your initial investment.

Part of identifying successful stocks can also mean having access to the dividends that companies pay and, crucially, ensuring these dividends keep growing over time.

Taking that into account, here’s list of five reasons why I think dividends are important when investing in stocks.

1. Dividends make up a large part of long-term returns

It is a little-known fact that over the long term, dividends actually make up a large part of the total returns that shareholders receive from their individual stock investments.

Total returns take into account what would happen if you had reinvested your dividends into the stock every time you received some.

Reinvesting dividends can quickly compound your initial investment as dividends continually add to your total return.

For example, in Asian stock markets such as Singapore or Hong Kong, dividends make up a significant portion of total longer-term returns.

2. Dividends can provide an additional source of income

For most people, the salary from their job is their sole income but if we have dividend stocks an extra income stream is a possibility – especially in Singapore where dividends are not taxed.

As different societies age at a faster rate though, age-related expenses also increase. It’s also widely-known that older investors are infinitely keener on dividend-paying stocks.

However, that usually refers to higher-yielding, more stable stocks with minimal growth.

For young people, though, we can always invest in stocks that have fast-growing dividends as well as big growth potential.

Dividends can be a smart way of helping you build up multiple streams of (tax-free) income over time.

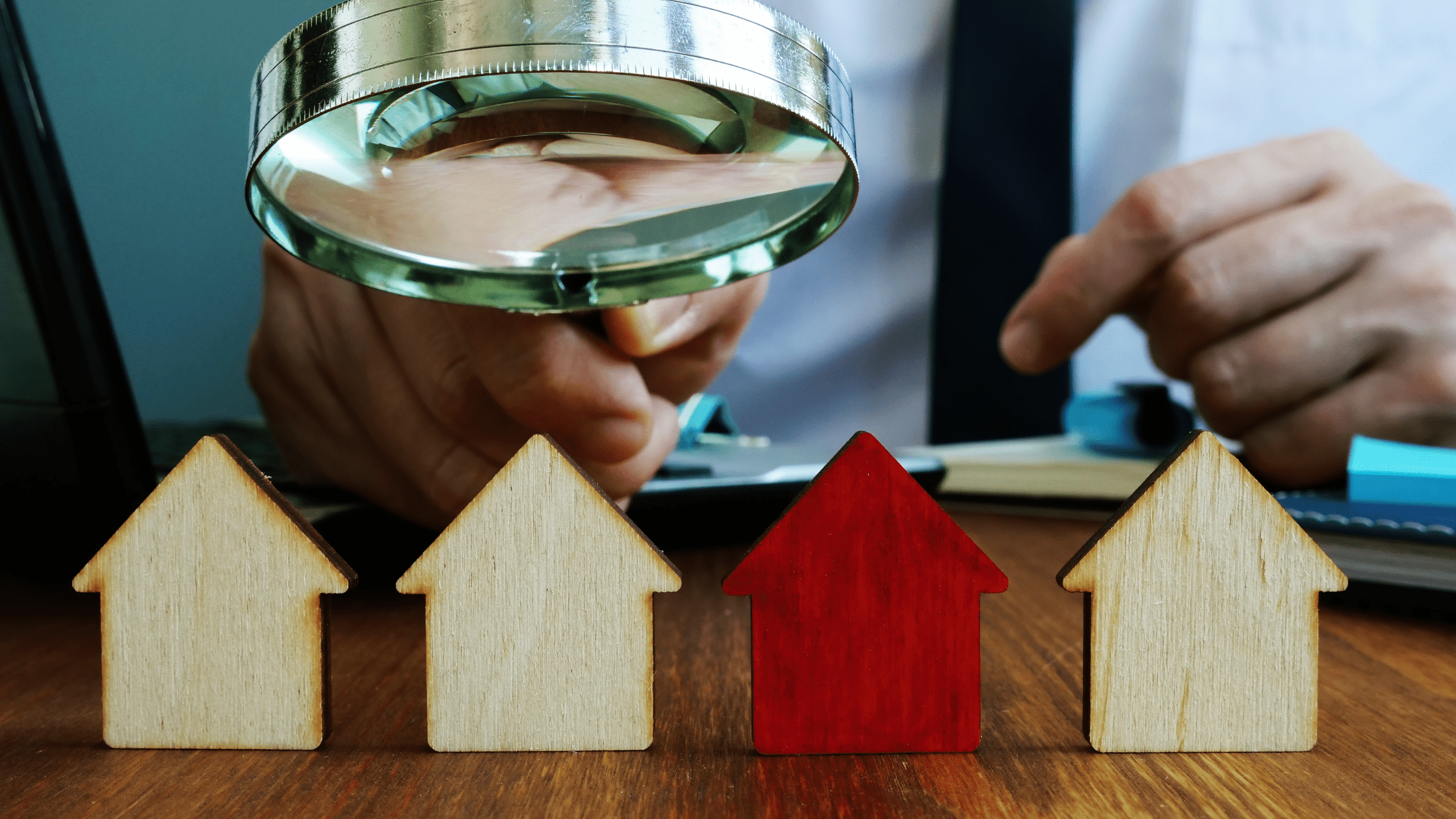

It would also be useful to study the track record of a stock’s dividends to determine whether these dividend payments are sustainable, and likely to grow, in the future.

3. Dividends can support stock prices during market volatility

Dividend stocks are generally viewed as more “safe” than other stocks when the stock market declines.

This is because as long as the company is earning enough money to pay dividends, you will receive a payout.

As a result, the stock prices of reliable dividend stocks do not tend to suffer as much as growth stocks in a down market.

This is because if the “dividend yield” – in effect the amount you receive in dividends as a percentage of the stock price – is attractive enough then buyers will be drawn back into the stock.

4. Dividends make your money work for you

Making your money work for you is one of the key appeals of dividends. Compare this to putting your money into a deposit savings account or buying Singapore Savings Bonds (SSBs).

For example, putting S$100,000 into the latest SSB would give you an average annualised return of just under 1% if you held them to maturity (10 years).

Admittedly, that’s a “safe” income but it falls far short of the potential yields that even fast-growing dividend stocks can offer.

Meanwhile, stocks that pay dividends have both the income aspect AND the potential for capital appreciation – basically what savings deposits/SSBs cannot offer.

5. Dividend stocks a good starting point

Finally, stocks that pay reliable dividends are typically found in more mature sectors. As a result, the companies that operate in that space tend to be strong, blue-chip companies.

Investors starting out on their investment journey may find these types of dividend stocks (such as Dividend Aristocrats in the US) more familiar and less volatile than other stocks.

Having a few solid, big dividend-paying companies can be a great foundation to become familiar with investing and stock markets before delving into other areas such as growth stocks.

Dividends and diversification

In summary though, it’s wise to remember that dividend stocks should be just one part of your portfolio.

But before investing in a stock you would be remiss not to consider what dividends the company pays out.