What is Dividend Investing?

For investors, dividend payments are essentially akin to “free money” being given to you just for holding the shares of a certain company.

But where do these payments come from? Naturally, companies generate profits and it’s from these profits that they pay shareholders a dividend.

Typically, dividends are paid out to shareholders if there’s excess cash that management doesn’t think it can re-invest into the business.

As a result, for investors, dividend stocks tend to be more stable, profit-generating businesses. In Singapore, there are many reliable dividend-paying stocks, such as leading bank DBS Group Holdings Ltd (SGX: D05) or real estate investment trusts (REITs) such as CapitaLand Mall Trust (SGX: C38U).

How to approach investing in dividend stocks?

However, approaching dividend investing should be the same way we approach broader investing. First and foremost, this means diversification. This can come from investing in different sectors, but most importantly, countries too.

As Singapore’s stock market is very small this, by default, makes the opportunity set available to investors small as well.

So how do investors counter this? Well, we can look towards the US and Hong Kong markets for dividend stocks that have much bigger businesses but are also growing their dividend at a faster rate.

Second, identifying these great dividend-paying companies and holding on to them for the long term will enable us to generate those income streams that we all strive for.

Why invest in dividend stocks?

The rationale for investing in dividend stocks is simple – cash sitting in a deposit account will likely only be paying you interest of less than 1%.

Sure, there are some specific bank accounts in Singapore that can offer rates above 1% but that’s on condition of certain requirements being met (such as credit card spending or investing with their wealth management arm).

Instead, if investors want to see a positive return on their cash holdings then putting it to work in dividend stocks is one of the best ways to do it.

That’s because dividend stocks usually provide investors with a yield of at least 4% or more.

Although the stock price will of course fluctuate over time, if you’re holding your dividend stocks for five years or more then you are likely to see a positive total return (which includes capital appreciation of the share price + any dividends received).

Metrics to identify dividend stocks

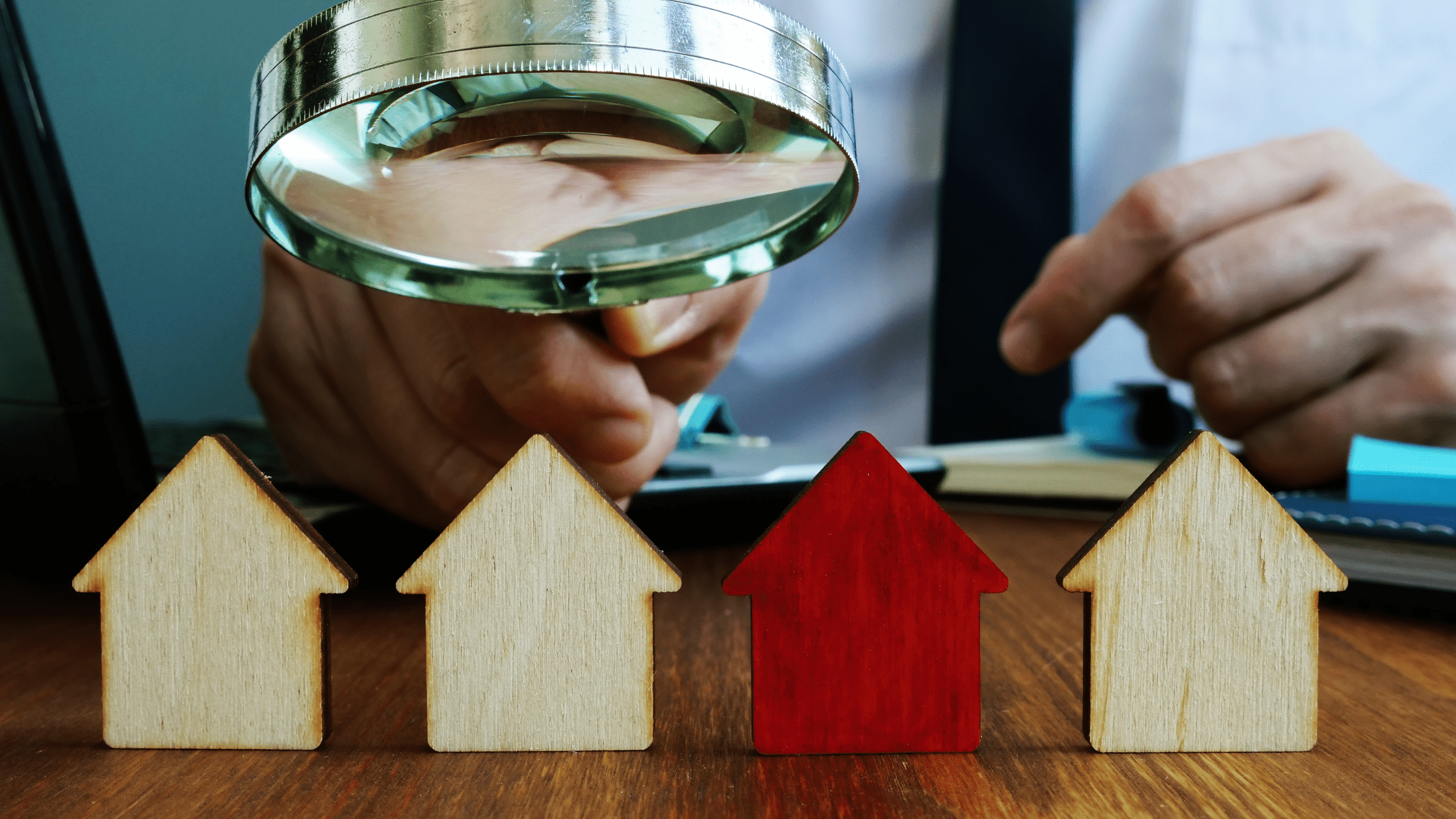

Before investing in dividend stocks, it’s useful to run a few tests on companies by looking at certain financial metrics.

As long-term investors, we ideally want to identify companies that are paying a solid dividend that is also growing at least in line with the inflation rate.

Here are some metrics to monitor when deciding which dividend stocks to invest in:

Dividend yield

This is the annual percentage (as a fraction of the share price) that you will get paid every year in dividends. However, with regards to dividend yields, higher does not always mean better.

If a company’s dividend yield is too high – say 10% or above – it’s usually a sign of stress on the dividend or that the stock’s share price has fallen significantly. To be on the safe side, look for dividend yields in the range of 3-6%.

Dividend payout ratio

This is the percentage of a company’s profits that are paid out as dividends. For example, say that DBS Group has full-year earnings per share (EPS) of S$3.0 and it pays a full-year dividend per share (DPS) of S$1.50.

The dividend payout ratio is the EPS/DPS. Effectively, that would mean that DBS has a dividend payout ratio of 50%. Generally, if a company can keep it within 30-60% of their earnings, then its dividend can sustainably grow – even if earnings fall temporarily.

Free cash flow

This is an important yardstick for the safety of the dividend as it gives you an idea of how much cash a company has after cash outflows from operations.

Free cash flow is an alternative measure of profitability and provides investors with a snapshot of the cash that’s available to the company to pay dividends to shareholders.

A company with strong free cash flow is much more likely to be able to maintain its dividend, and even grow it, over time than one that has weak free cash flow.

Benefits of dividend investing

There are many benefits to dividend investing and, more specifically, dividend stocks themselves.

Because dividends are paid out regularly, they can provide investors with a predictable extra income stream from their investments.

Additionally, one of the best things about dividends for investors in Singapore is that they are tax free which means that every cent that you receive in dividends is yours.

With no capital gains tax or dividend tax in Singapore, investing in dividend stocks makes it rewarding for long-term investors looking to generate reliable passive income streams.

Delivering both income and the potential for share price appreciation, investing in dividend stocks can be rewarding for any investor, no matter how old you happen to be.