Why Should I Buy US Stocks?

When we think of entrepreneurship and business, we tend to think of the stock market and capitalism.

No country better encapsulates these ideas than the US. That’s because some of the biggest listed companies in the world call the US home.

These include giants we are all familiar with; iPhone maker Apple Inc (NASDAQ: AAPL), video streaming platform Netflix Inc (NASDAQ: NFLX), electric car manufacturer Tesla Inc (NASDAQ: TSLA) and e-commerce and cloud computing giant Amazon.com Inc (NASDAQ: AMZN).

Those are just some examples. The US is also one of the first places to go if a company wants to list. That’s because the stock markets there have many professional and institutional investors who want to invest for the long term.

As a result, you see companies from all over the world listing in the US, via what is known as American Depositary Receipts (ADRs). These are essentially the same as shares but is the name given to foreign companies’ US-listed stock.

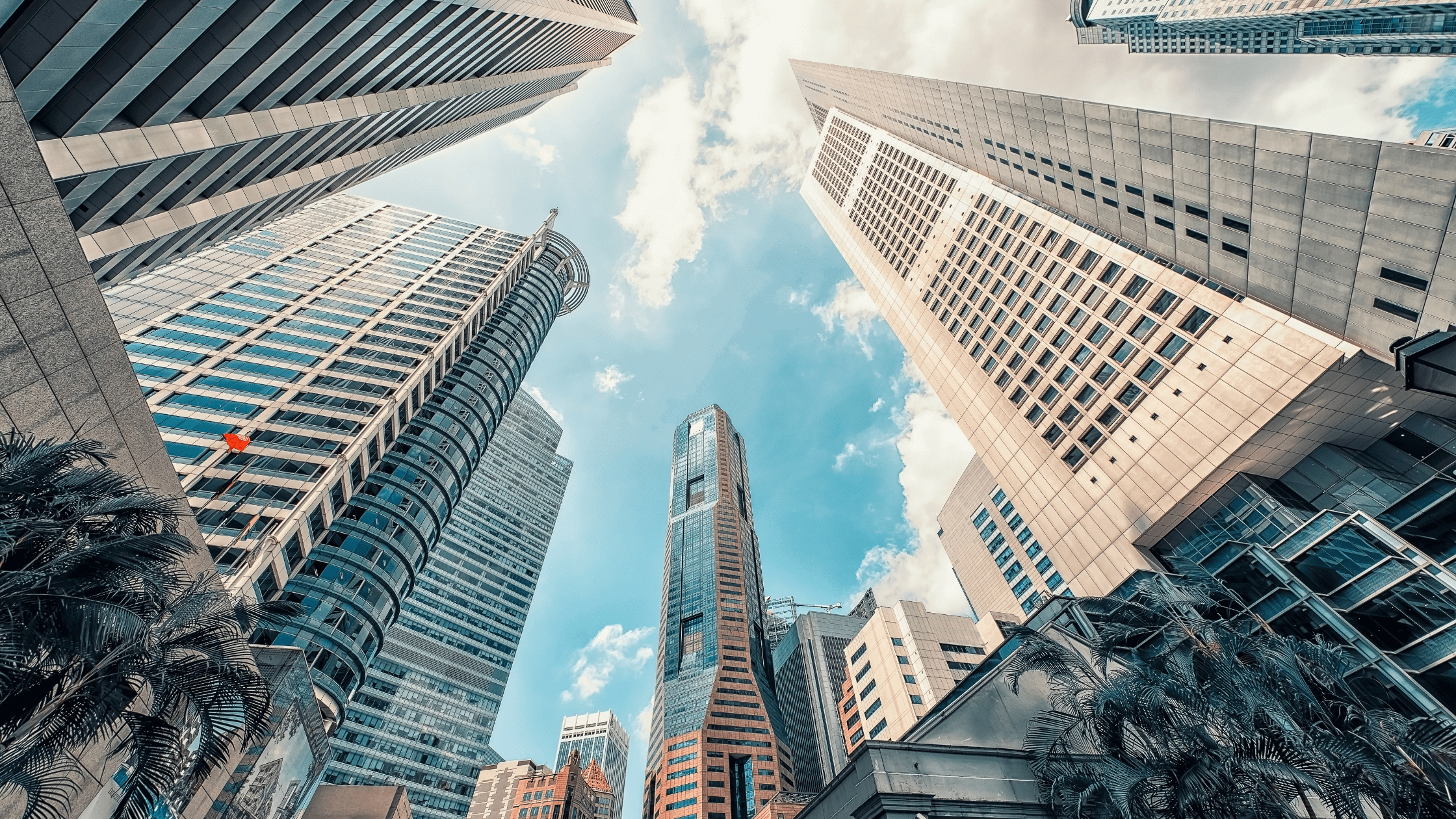

Overview of US stock markets

The size and heft of the US stock market is evident. As of the middle of 2020, the total market capitalisation (market cap) – which is the dollar value of all shares added together – of US-listed stocks was over US$38 trillion.

To put that into context, the whole world’s stock markets combined amount to about US$88 trillion. That means stocks on US markets alone account for over 40% of the world’s total market cap.

These numbers will no doubt fluctuate somewhat. However, the percentage ratios won’t change that much. Simply put, investors of all ages need to have some exposure to US markets when they set out to invest.

More broadly, the US stock market can be divided into three buckets in terms of the exchanges available to investors:

- New York Stock Exchange (NYSE) – The oldest stock exchange operator in the US, it dates back over 200 years and the total value of all its listed firms totals around US$28.5 trillion.

- Nasdaq (NASDAQ) – This stock exchange operator, also based in New York, has a shorter history of operation (going back to 1971) but the exchange’s technology-centric focus means fast-growing technology firms tend to list on the Nasdaq. The total market cap of companies listed on the exchange totals over US$10 trillion.

- Over-the-counter stocks (OTC) – OTC stocks refers to companies that have a listed presence in the US but do not require to be registered or reporting to the market regulator in the US – the Securities and Exchange Commission (SEC). As a result, there is less regulatory scrutiny of these companies.

Market sectors

The stock market in any country tends to be an accurate reflection of the future of the actual economy.

What is meant by that is that the companies that investors will believe will continue to do well in the future tend to feature the heaviest in how, for example, market indices are constructed.

In that sense, in the US, the technology sector plays an outsized role in the stock market. As of the end of 2019, the information technology sector accounted for just over 23% of the S&P 500 Index.

Even this massive number probably understates the influence of technology on the index. That’s because many companies we would think of as “technology-first” are classified under different sectors, such as Consumer Discretionary (where Amazon sits).

The S&P 500 Index is the broadest benchmark for investors (versus the more narrow-focused Dow Jones Index), as the S&P 500 includes the 500 leading companies in the US – representing over 80% of the available market cap.

S&P 500 Index breakdown by sector weighting

| Sector | Weighting (%) |

| Information Technology | 23.2 |

| Healthcare | 14.2 |

| Financials | 13.0 |

| Communication Services | 10.4 |

| Consumer Discretionary | 9.8 |

| Industrials | 9.1 |

| Consumer Staples | 7.2 |

| Energy | 4.4 |

| Utilities | 3.3 |

| Real Estate | 2.9 |

| Materials | 2.7 |

Source: S&P Indices, as of 31 December 2019

What are the biggest companies?

Given the size of the technology sector, it’ll come as no surprise to investors that companies in the sector dominate the “top of the pops” list in terms of market capitalisation of individual stocks.

For example, the three largest companies in the world currently are Apple Inc (NASDAQ: AAPL), Amazon.com Inc (NASDAQ: AMZN) and Microsoft Corporation (NASDAQ: MSFT), all with market caps that exceed US$1.5 trillion.

These giants’ influence on the US stock market is likely to persist as the role of technology only becomes more important in the global economy.

Beyond those big three, there are also the two other companies that complete the famed “FAAMG” stable: Facebook Inc (NASDAQ: FB) and Alphabet Holdings Inc (NASDAQ: GOOG), also known as the parent company of search firm Google.

These five stocks alone account for nearly one-quarter of the S&P 500’s total market cap. It shows us that as long-term investors in US companies, we can’t afford not to be invested in the broader technology sector.