1 Big Number From MercadoLibre’s Latest Earnings

Amid a global pandemic last year, it was no surprise that e-commerce companies saw a surge in business as people stayed indoors.

Globally, lockdowns meant that consumers were spending online and having all sorts of goods delivered to their door.

Yet, when the world goes back to some sort of “normal”, will this trend persist? I believe it will given the convenience and ease of online shopping.

One of the biggest beneficiaries of that trend to shop online has been MercadoLibre Inc (NASDAQ: MELI), a Latin American e-commerce giant that is also expanding into payments.

The company recently released its fourth-quarter 2020 earnings and they were impressive. However, despite that, MercadoLibre shares fell.

Yet I think short-term traders are ignoring the potential of one big part of MercadoLibre’s business.

Building a payments ecosystem

Taking a page from Alibaba Group Holding Ltd’s (NYSE: BABA) (SEHK: 9988) playbook and its AliPay payments system, MercadoLibre is starting to build out its own payments ecosystem. Naturally, this can complement its already-sizeable e-commerce presence.

Given e-commerce penetration in Latin America is among the lowest in the world – at around 5-6% of total retail sales – the growth potential is still huge for MercadoLibre.

Yet even though net revenues at its core commerce business nearly tripled (on a local currency/FX-neutral basis) to US$873 million, its fintech unit is where investors should increasingly focus.

That’s because MercadoLibre’s fintech division, in its latest quarter generated about one-third of its overall revenue.

Offline starts to dominate

The bulk of this comes from its Mercado Pago payments service, a digital wallet of sorts in a region where the total number of under-banked individuals is high.

What’s exciting about Mercado Page is how it’s growing in relevance away from the MercadoLibre e-commerce ecosystem.

That’s the same sort of trajectory that AliPay took, initially being used predominantly on Taobao and Tmall, before growing into a mainstay of the broader Chinese economy – used for everyday transactions.

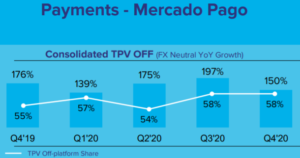

Similarly, Mercado Pago’s share of “off-platform” payments is growing. Although its local currency growth rate dropped off slightly in the fourth quarter to 150% year-on-year (see below), its off-platform payments business now makes up 58% of total payment volume (TPV).

Source: MercadoLibre Q4 2020 earnings presentation

That’s a key number because I expect it to grow over time as Mercado Pago becomes a more regular payments option in MercadoLibre’s key markets of Argentina, Brazil and Mexico.

That’s not to mention the other Latin America markets where digital payments penetration is low, such as Colombia, Chile and Uruguay.

Looking further out

MercadoLibre had an extraordinary run in 2020, gaining more than 150% yet the company still has a market capitalisation under US$100 billion.

The growth runway for the firm remains sizeable. So, for long-term investors who believe the company’s payments platform will grow into a Latin American giant, the reaction to MercadoLibre’s latest earnings shouldn’t worry them in the least.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of MercadoLibre Inc and Alibaba Group Holding Ltd.