Tesla Shares: Are They a Buy on Index Inclusion?

Tesla Inc (NASDAQ: TSLA) shares gained over 13.2% in after-hours trading after it was announced the firm will enter the S&P 500 Index. Is it too late for investors to buy?

Tim’s Take:

Tesla and Elon Musk, in particular, ignites a lot of debate. Analysts and investment professionals seem to either “hate him or love him”.

What no one can argue with is the product that Tesla has built; a superior auto experience that is both comfortable, sleek and energy-efficient.

Tesla has been labelled the “Apple of autos” and you can see why. The design aesthetic, attention to detail and high customer satisfaction ratings are all hallmarks of the iPhone producer.

Index inclusion in the S&P 500 was something Musk missed out on with Tesla a few months ago. Shares in Tesla duly fell. However, everyone knew that it was only a matter of time before the auto giant was included.

It seems that ratcheting up the case for inclusion was another positive quarter of earnings for Tesla in its third-quarter 2020 update.

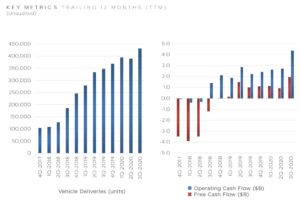

Total revenue for the quarter was up 39% year-on-year to US$8.77 billion. Tesla is also starting to build up momentum in terms of both free cash flow and operating cash flow (see below).

Source: Tesla Q3 2020 earnings presentation

However, the big number was that GAAP net income was positive at US$331 million – marking its fifth consecutive quarter of profits.

That was probably what put it over the finish line in terms of being included (the S&P 500 Index inclusion committee requires companies to have at least four consecutive quarterly profits on a GAAP basis).

Tesla, with a market cap of just shy of US$400 billion, will one of the biggest new entrants into the index.

Tesla inclusion and passive trillions

With a whopping US$12 trillion in passive money tracking the S&P 500 Index, it’s not hard to see why Tesla will benefit from inclusion.

The upshot is that a lot of these exchange-traded funds (ETFs) will be forced to buy Tesla stock, whether they want to or not.

At the end of the day, that’s the beauty of index inclusion for any company – the wall of passive money that’s forthcoming.

Beyond that, Tesla is riding a huge trend and is the market leader in the space. In 2010, about 17,000 electric vehicles (EVs) were on the world’s roads.

At the end of 2019, that number had exploded to 7.2 million, according to a report by the International Energy Agency (IEA).

The reinvention of the whole production and manufacturing process of autos has placed Tesla at the apex of this innovation.

Leading the pack in electric cars

Instead of outsourcing the many parts required for an internal combustion engine (ICE) to external vendors – which the likes of Volkswagen Group (FRA: VOW3) and Toyota Motor Corp (TYO: 7203) do – Tesla is able to manufacture nearly entirely by itself.

This “vertical integration” structure has ensured that Tesla is not reliant on external vendors for parts or production. As Musk says, “We made the machine, that made the machine that made the machine”. More control equals a better product.

Production of Tesla models has grown with new “Gigafactories” being built in Shanghai, Berlin and Texas to meet rising demand in all the major regions.

Not many people focus on the mechanics of an EV but it’s a big part of why traditional cars will be phased out. A typical electric engine has around 20 moving parts while an ICE engine has approximately 2,000 – 100 times as many.

The more moving parts, the more potential for things to go wrong. Electric engines, besides the widely-known environmental benefits, mean that maintenance and “wear and tear” remain to a minimum.

For investors who want to be invested in a big trend and a leader in the EV space, Tesla looks set to be making all the right moves as a business.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.