3 Charts From ARK Invest’s “Big Ideas 2021”

For someone who runs an active exchange-traded fund (ETF) portfolio, Cathie Wood has been nothing short of a phenomenon.

The founder and CEO of ARK Invest delivered some stunning returns in 2020 across a range of its renowned ETFs. She has been a big supporter – and shareholder – of Tesla Inc (NASDAQ: TSLA) for some years now.

Identifying the winners from “megatrends” is what ARK aims to do. Its latest “Big Ideas 2021” report looks at 15 key themes that investors should watch out for in 2021 and beyond.

Here are three charts that I found interesting for those of us looking at investing over the long term and hoping to benefit financially from how the world is evolving.

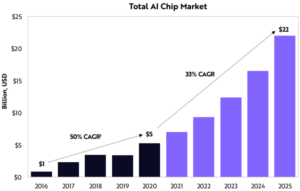

1. Booming AI chip market

Semiconductors power everything in today’s world. It’s hard to imagine they could get more important in future but that’s inevitably going to be the case.

ARK think that’s data centre spending on artificial intelligence (AI) chip processors will grow by over 300% in the next five years, from US$5 billion today to US$22 billion in 2025 (see below).

The amount of computational power that will require will clearly be immense, both from the design and manufacturing sides.

Some of the winners in that space could include chip foundries such as Taiwan Semiconductor Manufacturing Co (TSMC) (TPE: 2330) (NYSE: TSM), semiconductor fabs like Nvidia Inc (NASDAQ: NVDA) and Advanced Micro Devices Inc (AMD) (NASDAQ: AMD), and deep-learning and AI specialists such as Alphabet Inc (NASDAQ: GOOGL).

Source: ARK Invest Big Ideas 2021

2. Online gaming revenues are shifting

It’s no secret that online gaming is big business. With the rise of e-sports and regular events with millions of dollars of prize money on offer, gaming has evolved to the point where it’s almost unrecognisable from where it was even a decade ago.

As ARK states, the shift in video game monetisation over the past 10 years is seeing in-game purchases make up a bigger and bigger share of the revenue pie (see below).

By getting users to remain within a game’s ecosystem, and keep spending, gamin firms are able to tap into a much more sustainable business model than being reliant on one-off premium game purchases.

It’s clear that the big gaming winners from this trend will include the likes of Tencent Holdings Ltd (SEHK: 700), Sea Ltd (NYSE: SE), Activision Blizzard Inc (NASDAQ: ATVI), Nintendo Co Ltd (TYO: 7974) (OTC: NTDOY), and the big two console makers Microsoft Corporation (NASDAQ: MSFT) and Sony Corp (TYO: 6758) (NYSE: SNE).

Source: ARK Invest Big Ideas 2021

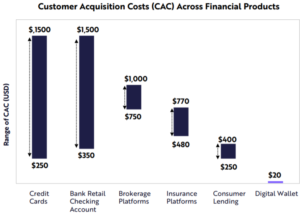

3. Digital wallets are the future

Payments in the digital form have taken off amid the Covid-19 pandemic. Although they were always growing fast, the past year has seen that trend turbocharged.

In fact, ARK estimates that in the US the number of digital wallet users is surpassing the number of deposit account holders at the largest banks.

It goes on to highlight that at the end of 2020, JP Morgan Chase & Co (NYSE: JPM) had deposit account holders that numbered 60 million.

In contrast, by the end of 2020, PayPal Holdings Inc’s (NASDAQ: PYPL) Venmo app had reached annual active users (AAUs) of 69 million.

The reason? Acquisition costs are low for digital wallet providers versus more traditional means of banking (see below).

That is going to mean huge disruption in the banking industry over the next decade. Likely winners will be the aforementioned PayPal as well as Square Inc (NYSE: SQ) and even Alibaba Group Holding Ltd (NYSE: BABA) (SEHK: 9988) through its holding in payments giant Ant Group.

Source: ARK Invest Big Ideas 2021

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of PayPal Holdings Inc, Square Inc, Sea Ltd, Microsoft Corporation, Alibaba Group Holding Ltd and Taiwan Semiconductor Manufacturing Co.