Zoom Stock is 40% Off Its Highs. Is it Still Worth Buying?

Amid a huge run-up in US stock markets, as well as a seemingly gravity-defying ascent by Tesla Inc (NASDAQ: TSLA), investors would be remiss to think everything has been rising.

That’s not been the case for video-conferencing specialist Zoom Video Communications Inc (NASDAQ: ZM). Although the company has now become a verb, its share price is actually down around 40% from its all-time high (set in October) of around US$588 per share.

However, investors who had bought Zoom shares at the beginning of 2020 would still have been sitting on a gain of around 400% by the end of the year. I’ve written previously about why Zoom’s sell-off was expected and why it will be fine long term.

Perhaps unsurprisingly, the market’s focus on Zoom proved fleeting as it turned to other “hot” stocks in sectors such as electric vehicles (EVs).

Meanwhile, not much has changed with Zoom’s fundamentals. The company remains extremely cash-generative and what’s even better, for a tech firm, it’s also profitable.

Despite many investors falling out of love with Zoom, here’s why I think its growth story is just getting started.

Explosive growth…potential

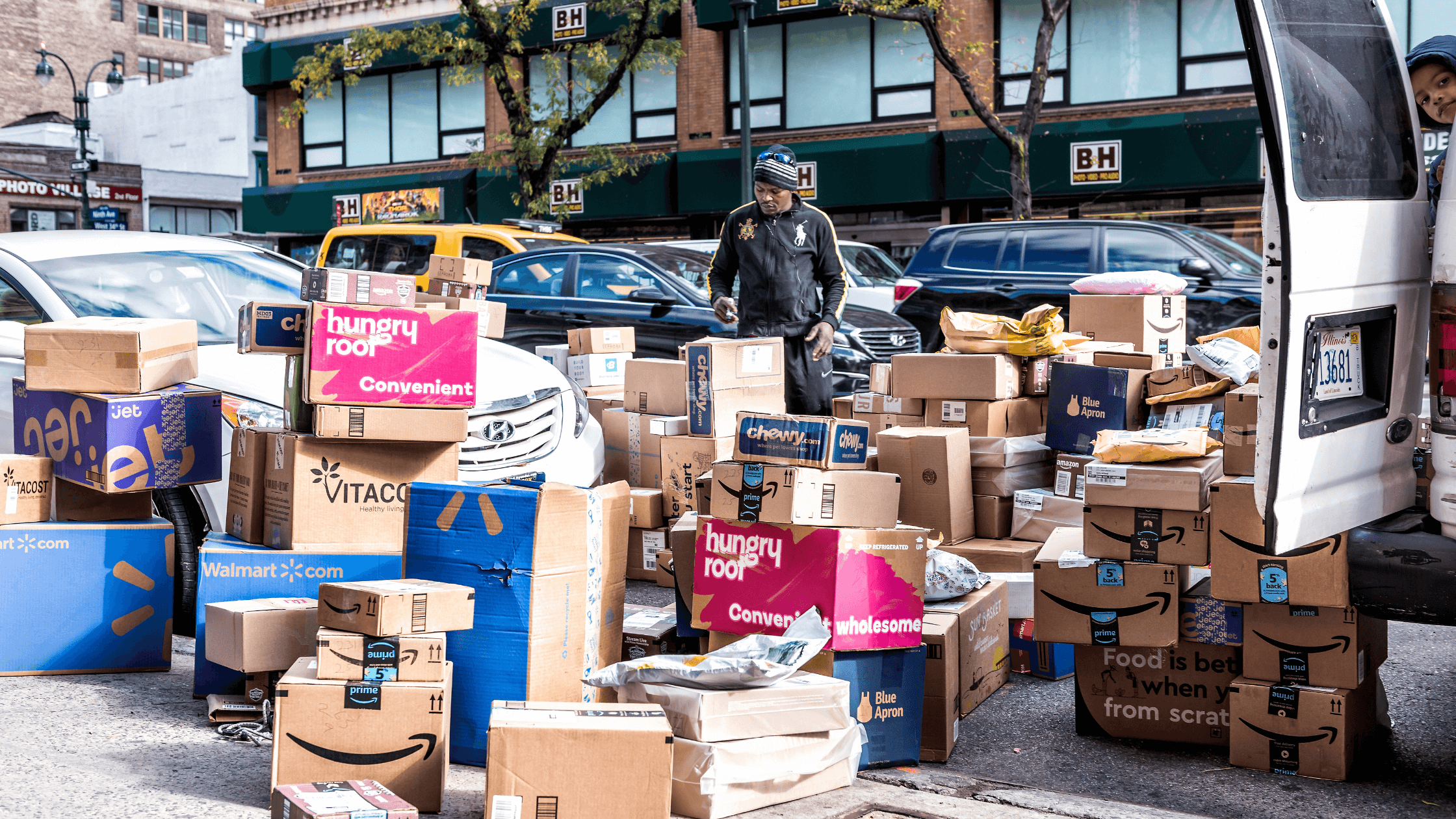

A lot of chatter has been about Zoom’s explosive revenue growth. For better or worse, “let’s Zoom” ended up encapsulating 2020 amid a global pandemic.

Used initially for enterprises, Zoom has quickly expanded, and entrenched itself, in the consumer realm. The company crushed earnings expectations in its third-quarter FY2021, with revenue rising 367% year-on-year to US$777 million.

What’s perhaps more impressive is Zoom’s traction in the enterprise space, where it now has 1,289 customers that contribute over US$100,000 in trailing 12-month revenue.

That figure was up 136% year-on-year. Elsewhere, Zoom’s operating cash flow and free cash flow are both on a tear (see below).

Source: Zoom Video Communications Q3 FY2021 earnings presentation

This is just the start, though. Zoom this week announced that it has reached one million paid Zoom Phone seats – an add-on service within its ecosystem that allows enterprise users to make and receive calls, record calls, listen to voicemails and send texts.

Attempting to disrupt the slow-moving telephony industry, it’s an impressive landmark for a service that has not even reached its two-year anniversary.

The great thing about the Zoom Phone service is, like the main offering, its ease of use while it also makes Zoom’s ecosystem more sticky for existing users.

Being able to have it up and running on enterprises’ platforms within 24 hours, it’s useable on either your mobile phone or a traditional office phone.

Strengthening balance sheet

Alongside the Zoom Phone announcement, the company also revealed it had raised US$1.75 billion via a new share offering. This will nearly double the US$1.87 billion it already has in cash on its balance sheet.

With zero debt, and now over US$3.5 billion in cash, Zoom’s management is clearly thinking long term about its expansion over the next three to five years as it builds out its capabilities in the communications space.

It’ll likely be a story of high earnings comparables this year for Zoom, as it laps itself on the extraordinary numbers it posted in 2020.

But the company’s founder and CEO, Eric Yuan, has always had a vision for making communications a seamless experience for users. That was proved beyond a doubt in 2020 as the company made its service free to hundreds of millions of new users.

Is Zoom staying with us?

On the key question of whether Zoom is here to stay, the answer is a simple “yes”. Obviously, when a vaccine does come, people will return to the office but it’s much more likely that a hybrid work model will emerge.

This means Zoom services still being an integral part of corporate life. Many corporates are realising that cross-continental and cross-country travel in many regions won’t be a necessity in a post-Covid-19 age.

As for competition, Microsoft Teams remains an enterprise-only application while Zoom’s video service has proved that it “just works” for the millions of users in both the enterprise and consumer worlds.

Longer-term investors who have the patience to see out three to five years from now will likely witness a Zoom that is vastly different, and more successful, than the one we see today.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Zoom Video Communications Inc.