Plug Power Shares Soar 13%. Is This Hydrogen Fuel Company a Buy?

Plug Power (NASDAQ: PLUG), a hydrogen fuel-cell specialist, saw its shares pop as it finished the day 13.3% higher as Morgan Stanley lifted its recommendation on the stock from Hold to Buy.

Tim’s Take:

In a recent report, Goldman Sachs calls it a “once-in-a-lifetime opportunity” that will have a total addressable market of a stunning US$12 trillion by 2050.

What is the bank referring to? Green hydrogen. With declining costs of production, along with hydrogen’s versatility as an emissions-free energy source, many investors are now starting to wake up and pay attention to this nascent corner of the renewables market.

Within the space, Plug Power is one of the leaders in hydrogen power technology. Traditionally, producing hydrogen has been costly given the energy-intensive nature of it.

However, with the advent of cheap renewables, that’s fast changing. It’s also perhaps why Plug Power, which has been public since 2002, has fared so poorly over the long term despite so many promising deals.

Green opportunities in hydrogen

Plug struck up partnerships with Walmart Inc (NYSE: WMT) and Amazon.com Inc (NASDAQ: AMZN), in 2014 and 2017 respectively, to supply forklift fuel cells for both retailers.

Despite some initial traction, the idea of hydrogen fuel-cells never took off given the cost and failure of widespread adoption. I believe that’s changing.

As the world shifts to figuring out ways to increase battery storage, there has also been space for hydrogen fuel to state its case for its storage capabilities while also being a carbon-free power source.

Plug, being the world’s largest user of liquid hydrogen, sees opportunities ranging from powering hydrogen fuel trucks in Europe to powering the vast amount of data centres that need clean energy.

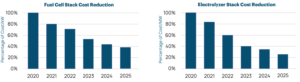

What’s more, it also foresees huge cost reductions over the next five years as increasing scale and vertical integration start to make a difference (see below).

Source: Plug Power investor relations as of September 2020

Its most recent quarter saw the company deliver record gross billings of US$72.4 million while third-quarter guidance was set at US$110-115 million in gross billings.

As the company builds out its hydrogen power fueling stations and strikes up renewable energy partnerships, like the one it recently inked with Brookfield Renewable Partners (NYSE: BEP), the green hydrogen future is looking bright for Plug and its shareholders.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Brookfield Renewable Partners LP.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.