Fastly Shares Rise Over 7%

Cloud edge computing provider Fastly Inc (NYSE: FSLY) saw its shares pop 7.3%. The content delivery network (CDN) specialist provides in helping clients accelerate faster webpage load times by helping manage demand loads.

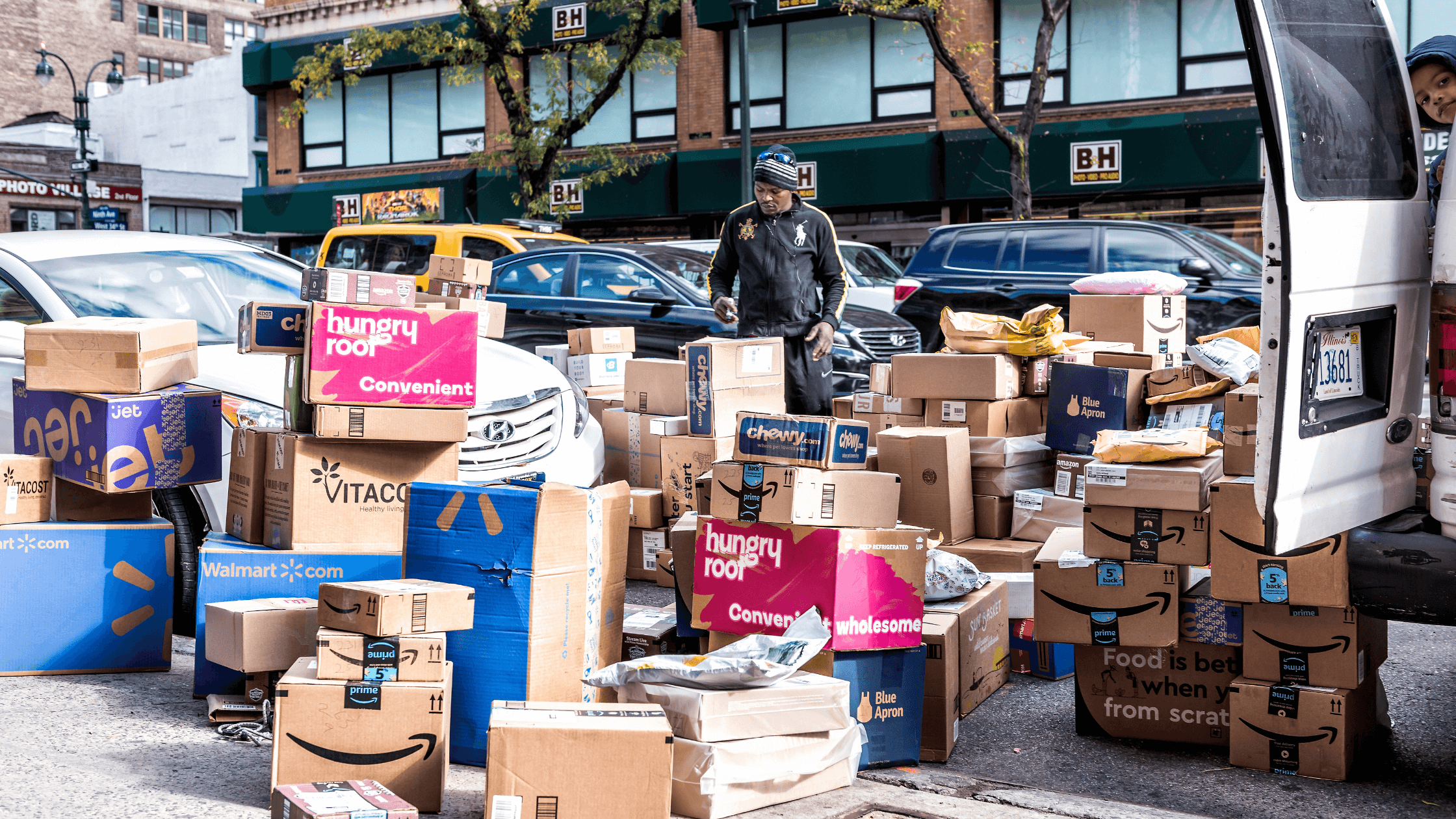

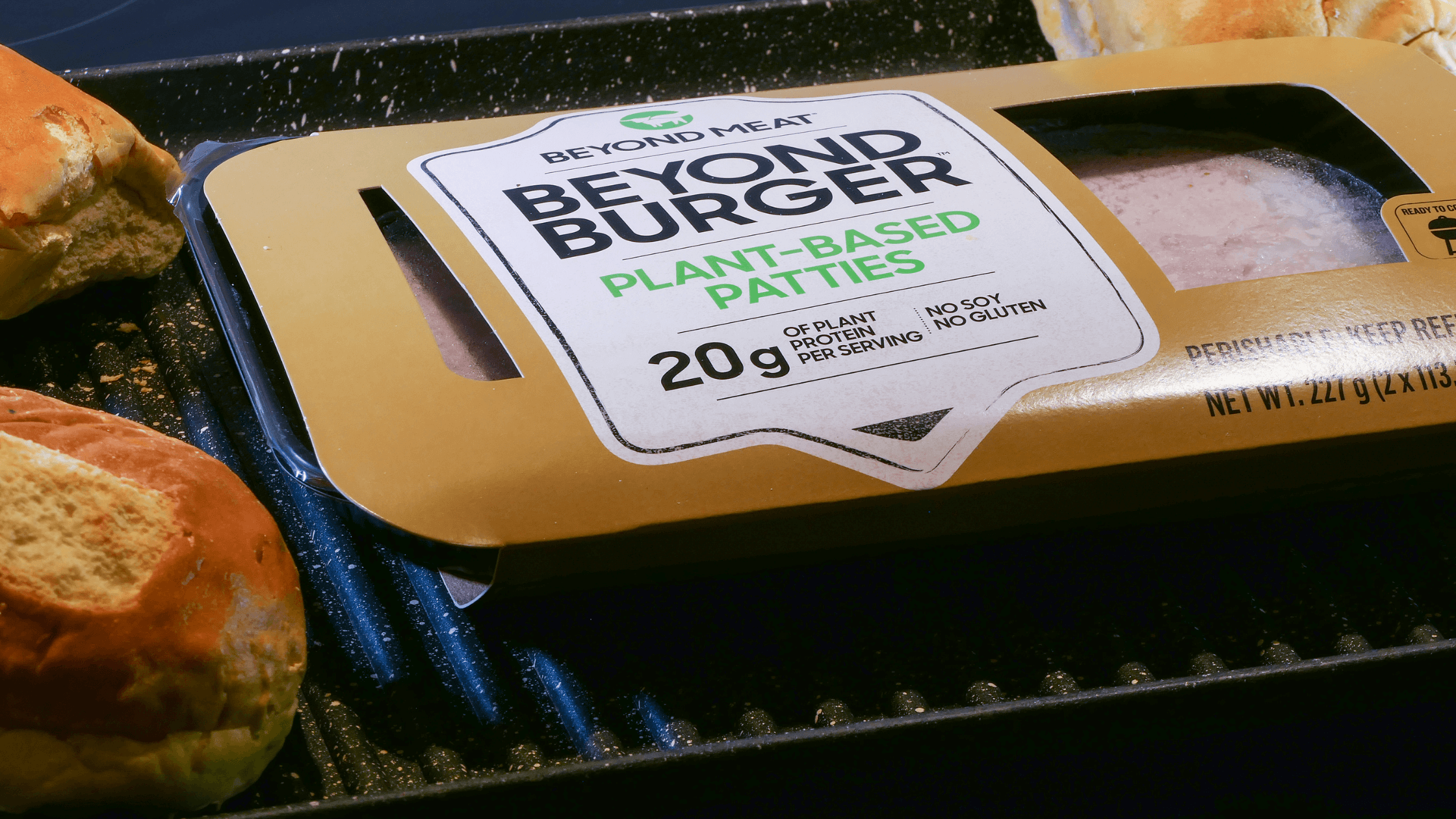

Clients of Fastly’s include the likes of video streamers, digital publishers, gaming platforms, social media providers and e-commerce websites, helping them deliver a more seamless experience to end users.

Shares of the firm have risen more than four-fold so far in 2020 as the rise in demand for managing the surge in traffic has exploded.

The firm’s shares sold off recently, despite its earnings beat, on news of TikTok’s ban in the US – TikTok contributes around 12% of its revenue.

However, clarifications on the broader ban and the hope that TikTok can continue to operate in the US under new ownership has appeased investors for now.

Regardless, the company is growing fast and looks set to tap into a growing trend for improving the end-user experience. Watch out for this infrastructure-as-a-service (IaaS) provider, it looks likely to keep growing.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.