Is TSMC the Best Semiconductor Stock?

Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM) (TPE: 2330) climbed 4.6% as the broader semiconductor space gained on investor optimism surrounding an economic stimulus.

Tim’s Take:

What does tech giant Apple Inc (NASDAQ: AAPL) have in common with chip giants Advanced Micro Devices Inc (NASDAQ: AMD), also known as AMD, and Nvidia Inc (NASDAQ: NVDA)?

They all use Taiwanese semiconductor foundry TSMC to manufacture their chips. In that snapshot, investors can see how important TSMC is within the whole semiconductor ecosystems.

As a foundry (a company that produces chips), TSMC owns the space. The largest company listed on the Taiwan stock exchange, TSMC itself makes up a whopping one-third of the overall TAIEX by market cap.

The reasons are manifold but increasingly it comes down to the simple fact that no other company has the capability to produce chips in the way TSMC does.

Technology production as a moat

Making a semiconductor nowadays isn’t just a matter of setting up shop and getting to work. It requires an immense amount of technological prowess. The company’s latest chip is evidence of that.

Measuring in at five nanometres (5nm), or five-billionths of a metre, its latest chips for Apple will fit more than 170 million transistors on to each square millimetre of silicon.

It’s an unbelievably arduous task of both precision and capital-intensive dexterity. TSMC’s latest production site (Fab 18) will require a monster capital outlay of some US$17 billion.

In that, you can already see that TSMC has a moat. Precision production of modern-day semiconductors is a huge barrier of entry to any newcomer looking to take market share from the incumbent leader.

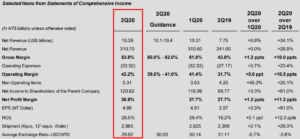

TSMC’s latest earnings confirm its rock-solid growth trajectory, backed up by expanding margins (see below). The company consistently beats estimates because it’s the “best of the best” in the space.

Source: TSMC Q2 2020 earnings presentation

Even with the US government’s ban on supplying chips to Huawei, the demand slack has been picked up by massive orders from Apple who need the Taiwanese giant to fulfill orders for its upcoming iPhone.

Watch out for more news on this front when the company reports its third-quarter earnings on 15 October.

No serious competition

Meanwhile, competitors in the chip space are nowhere close to it. The Chinese “national champion” that is SMIC has been crippled by US sanctions and is, anyway, at least two to three years behind TSMC in terms of technology know-how.

Finally, TSMC is a cash-generating machine and remains exceptionally well-managed. With a dividend yield of around 2% (and with only a 20% dividend withholding tax on its ADRs versus the usual 30%), investors can be paid to wait for long-term upside in this tech giant that is now worth over US$400 billion.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares in Taiwan Semiconductor Manufacturing Co Ltd.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.