Costco Shares Fall Even as August Sales Rise

American retailer Costco Wholesale Corporation (NASDAQ: DKNG) saw its shares initially climb on news of better August sales numbers.

However, the share price later fell with the broader market, ending the day down 2.9% – although this still outperformed the broader S&P 500’s decline of 3.5%.

Tim’s Take:

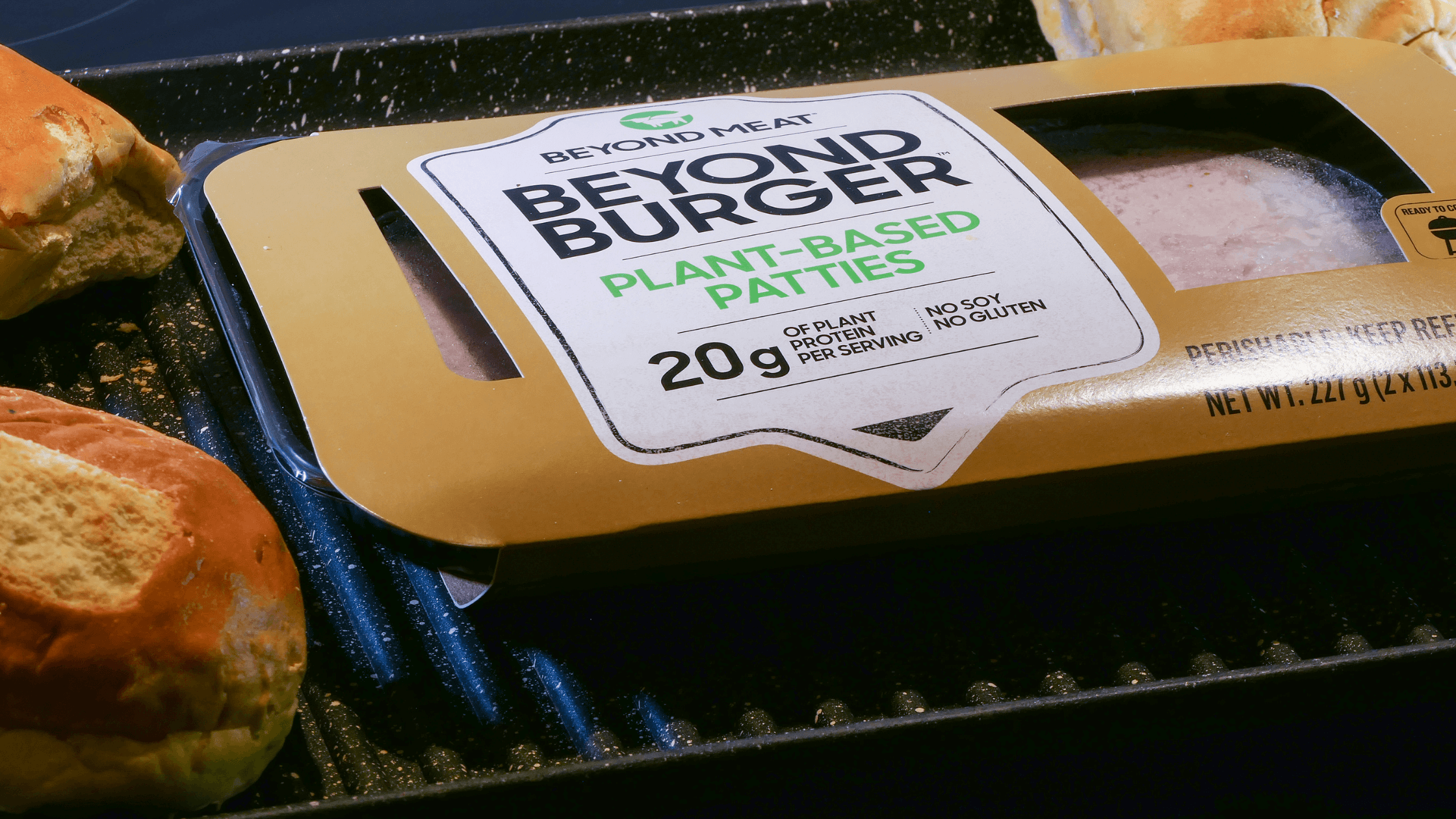

Costco is the epitome of stability in the retail space. The company runs a nationwide chain of membership-only warehouse stores that sell all manners of goods in bulk.

The company has a subscription service whereby members pay an annual fee in return for being able to access the low-cost goods that Costco sells wholesale at its locations.

It’s been a phenomenal success and that success continued throughout the Covid-19 pandemic. Costco’s latest August sales figures were remarkable. It recorded a 13.2% increase across all its stores in August versus the same month last year.

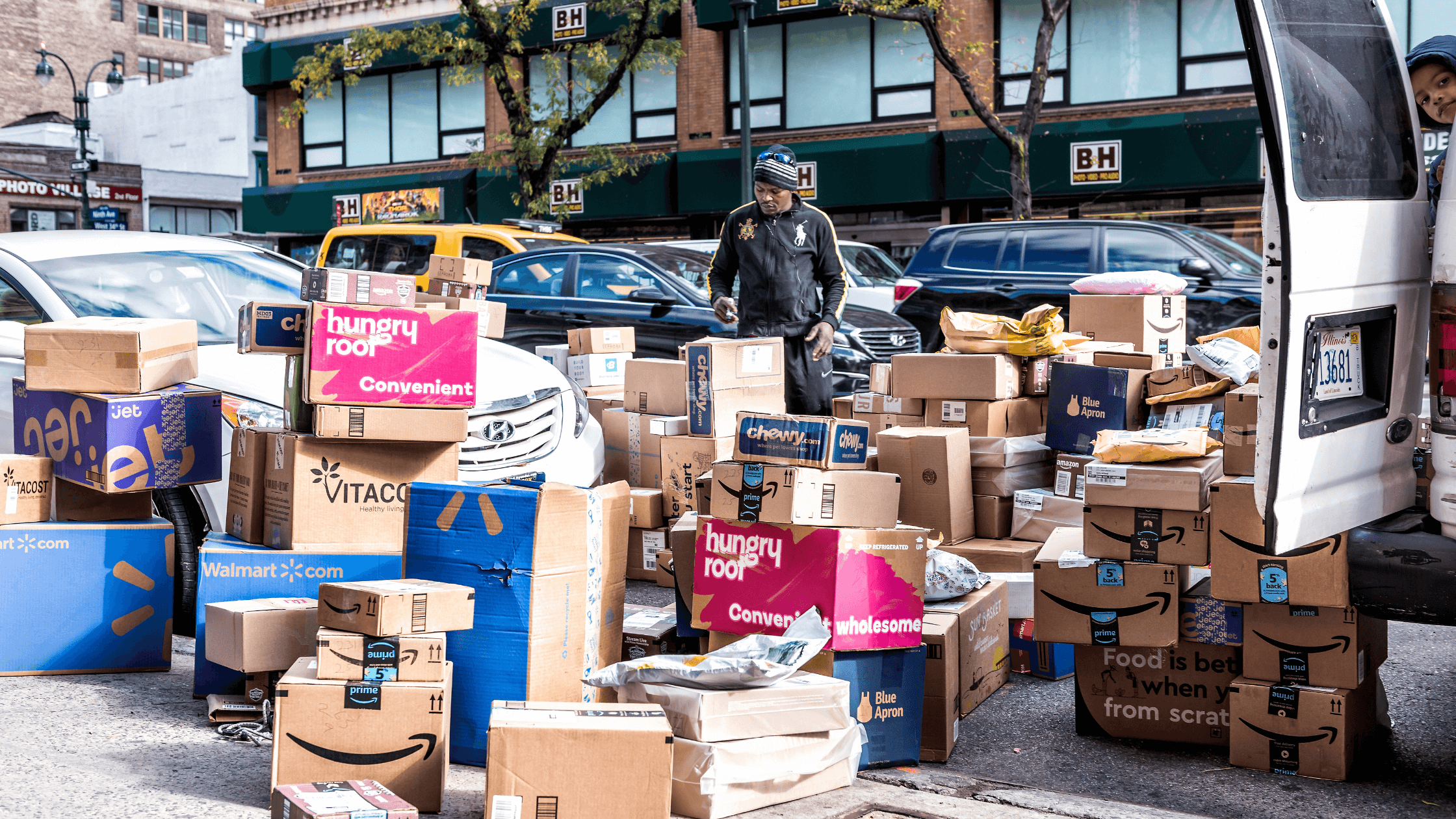

Meanwhile, online sales more than doubled in August. Total sales for the month sat at around US$13.6 billion – showing readers how much of a giant Costco actually is.

Costco keeps winning

What’s even more impressive is that the company boasts such a high membership renewal rate (of 91% in the US and Canada – where most of its outlets are).

Like other top-tier retailers in the US, the pandemic has highlighted those who have invested in their digital capabilities. Costco has been one of the key beneficiaries of its online presence and reliable customer base.

If that wasn’t enough, investors can also get a small dividend from Costco. It started off paying an annual dividend per share of US$0.40 back in 2004.

That annual DPS now sits at US$2.80, meaning it’s expanded at a compound annual growth rate (CAGR) of 13%.

Depsite that, Costco shares still yield only 0.8% and its dividend payout ratio is around 33%. That means there’s much more room for dividend growth ahead for investors who believe in the continued success of this unique retail business.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.