Can Intel Stock Recover After Huawei Greenlight?

Chip giant Intel Corporation (NASDAQ: INTC) received licenses from the US government that enable it to continue supplying blacklisted Chinese tech hardware firm Huawei. Intel shares ended the day up 0.5%. But can it recover its former glory?

Tim’s Take:

Investors familiar with the semiconductor industry will know that Intel used to be the darling of the industry.

Exclusive partnership and supply agreements with Apple Inc (NASDAQ: AAPL) ensured it was the top dog in the chip space.

However, the landscape in the semiconductor industry has changed beyond recognition. Nowadays, you either design the chips – like an Nvidia Inc (NASDAQ: NVDA) – or you manufacture them en masse (as many Taiwanese so-called “foundries” do).

Intel tried to be different by being the only one in the space to do both. This turned out to be a huge mistake. By failing to invest enough into R&D on the production side, it has fallen too far behind leader Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM) (TSE: 2330).

Falling further behind

After losing Apple as a customer for its Macs – the tech giant is going to be designing its own chips in house based on Arm designs given Intel chips’ shortcomings on processing power – it now looks more than likely that Intel will outsource production of its own future chips to TSMC.

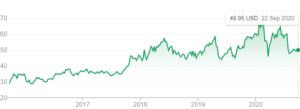

All this has obviously been negative for investors. The company’s shares are up around 70% over the past five years but over the past two years, they’ve been broadly flat (versus a 10% gain for the S&P 500).

Intel Corporation’s five-year share price performance (US$)

Source: Google Finance

This latest news on Huawei provides a brief respite for the company. But for long-term investors, some question marks remain over its direction.

Sure, it pays a 2.6% dividend and trades at a price-to-earnings ratio of just over 9x. Yet, I believe that instead of a bargain, this makes Intel a potential value trap.

Just because a company was great in the past doesn’t mean it’s going to adapt to and thrive in a new landscape. Unfortunately for Intel, it’s been found wanting in the chip space for a while now. I don’t see that changing any time soon.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Taiwan Semiconductor Manufacturing Co Ltd.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.