Should Dividend Investors Buy STORE Capital Shares?

STORE Capital Corp (NYSE: STOR) saw its shares pop 8% yesterday as brick-and-mortar REITs continued to surge. But should investors think about buying it?

Tim’s Take:

STORE Capital is a real estate investment trust (REIT) that has tenants that rely heavily on foot traffic. Whether that’s day care centres, restaurants or health clubs, STORE is an acronym for its business model – Single Tenant Operational Real Estate.

As I’ve written previously, STORE Capital is the only REIT that Warren Buffett’s Berkshire Hathaway Inc (NYSE: BRK.B) owns.

STORE has a portfolio spanning 2,587 properties and with 511 tenants operating across 110 different industries, it’s extremely well diversified.

Its top tenant contributes less than 3% of its base rents while over three-quarters of its tenants contribute under 1% of base rents.

That lends it a certain level of resilience, which it showed throughout the second-quarter lockdown by not cutting its dividend.

REITs getting back to normal

There’s no getting around the fact that STORE Capital was obviously hit hard by Covid-19. In terms of rent collections, the REIT only managed to collect 70% of rents in May but this has slowly been creeping up since.

As of the end of October, this was at around 90%. Some of the hardest-hit tenants have seen vast improvement in collection rates, including furniture stores, health clubs, education centres and restaurants.

Prior month open rates of its locations have also been picking up and are close to 100% now. This, the REIT noted, is a positive signal given the high correlation between rent collections and prior-month location openings.

Ultimately, all this has fed through to earnings (which were released last week). In the third quarter, STORE saw funds from operations (FFO) of US$119.1 million, equal to US$0.46 per share. That was only around 9% below the US$0.50 per share from the same period last year.

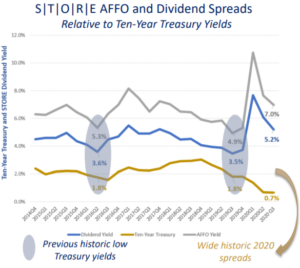

Furthermore, as investors rotate back into unloved sectors, STORE is likely to benefit. The REIT’s shares are trading at a relatively attractive 4.6% yield premium to the US 10-year Treasury (see below).

Source: STORE Capital Q3 2020 earnings presentation

For long-term investors wanting to put money to work in a “recovery” play of sorts, then STORE Capital is certainly one to watch.

I doubt the Covid-19 situation could return to the dark days of March (in terms of either shutdowns or number of deaths).

Now with news of an effective vaccine also forthcoming, the long winter ahead is already looking a bit brighter than it did only a few weeks ago.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.