2 Financials Stocks to Buy and Hold Long Term

A lot of investors have been avoiding the financials space as a big part of that sector – banks – look likely to keep suffering from low interest rates in the US and the fallout from Covid-19.

Yet, for longer-term investors, there are still plenty of opportunities about. That’s because financials, as a whole, covers many companies from asset managers to insurance firms to payment processors.

Many of those have also suffered from the Covid-19 pandemic yet they’re also set to rebound when a successful vaccine is widely distributed.

Beyond that, they are also riding on long-term trends. With that, here are two financials stocks in the US that long-term investors can comfortably buy to hold for years to come.

1. Visa

Everyone who has ever used a credit card has heard of Visa Inc (NYSE: V). The company is just one member of a payments duopoly, with the other firm being rival Mastercard Inc (NYSE: MA).

Visa, which traditionally you would think could benefit from cashless payments amid a pandemic, has actually seen its share price rise by around 9% so far in 2020.

That’s slightly below the S&P 500’s year-to-date return of just over 10%. Yet, there’s a reason why Visa stock has underperformed.

That’s because Visa, like Mastercard, relies heavily on cross-border spending to generate a big chunk of its profits. Think of a typical tourist spending on Visa’s credit cards when they’re travelling around Europe.

As a result of international travel falling off a cliff, Visa’s cross-border payments volumes experienced a similar vertiginous drop earlier this year (see below).

Source: Visa Q4 fiscal year 2020 earnings presentation

That hasn’t stopped Visa shares from reaching new record highs in late August, though. Now with a vaccine on the way, and with international travel perhaps somewhere on the horizon in 2021, Visa should continue to perform.

That’s because the company is benefitting from two mega-trends; first is the rise of cashless payments (who wants to touch dirty paper money in the post-Covid era?) and second is the likely continued growth of cross-border travel once Covid-19 is defeated.

Visa is also immensely profitable, generating GAAP net income of US$2.1 billion on US$5.1 billion of revenue in its latest quarter.

Although these numbers were down double-digit percentages year-on-year, a quick recovery is a very easy scenario to imagine.

For long-term investors who want exposure to the payments business within the financials space, Visa should be one of your top choices.

2. BlackRock

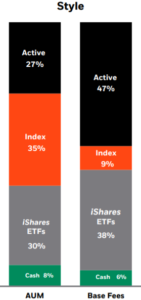

BlackRock Inc (NYSE: BLK) is one of the world’s largest asset managers. The giant, which is well-known for its iShares range of exchange-traded funds (ETFs), had assets under management (AUM) of a massive US$7.8 trillion as at the end of September.

BlackRock has made a name for itself under CEO Larry Fink for opening up access to various asset classes through the use of ETFs.

Disrupting the traditional asset management industry, which charges high fees for professional managers who underperform benchmarks, the offering of low-cost tracker funds has a unique appeal.

That’s because ETFs can scale easily, are cheap to run and don’t require a huge team of investment professionals to manage as it merely tracks an underlying market index.

However, that doesn’t mean BlackRock hasn’t offered up active asset management solutions. It also has a sizeable active management business.

In fact, its iShares ETFs offering made up 30% of AUM but brought in 38% of base fees for BlackRock in its most recent quarter (see below).

Source: BlackRock Q3 2020 earnings supplement

Net flows into its iShares ETFs have even remained positive throughout the first three quarters of this year.

Longer term, BlackRock is determined to position itself as the conduit between the mass market and financial markets.

Correspondingly, Fink has stood out as a trailblazer of responsible governance in the financial industry. Given BlackRock’s heft, he had penned a letter to chief executives of some of the world’s largest companies that the asset manager passively owns through its ETFs.

He had stated that individuals were increasingly looking to companies to deliver not only financial performance but a positive contribution to society.

This can only benefit BlackRock longer term as it captures more money that is looking to ETFs amid the growth of passive investing.

With BlackRock shares up over 300% since 2010, long-term investors should look to ride on the big wave of passive investing that the company is driving.

Disclaimer: ProsperUs Head of Content Tim Phillips doesn’t own shares of any companies mentioned.