Costco Shares Fall Despite Strong Earnings Report. Is it a Buy?

Costco Wholesale Corporation (NASDAQ: COST) reported a solid set of quarterly earnings but still saw shares fall over 2% in after-hours trading.

Tim’s Take:

Costco’s sales growth was impressive in the fiscal fourth quarter (for the three months ended 30 August 2020).

The discount retailer saw sales rise 12.5% year-on-year to US$52.3 billion versus the US$46.5 billion in the year-ago quarter.

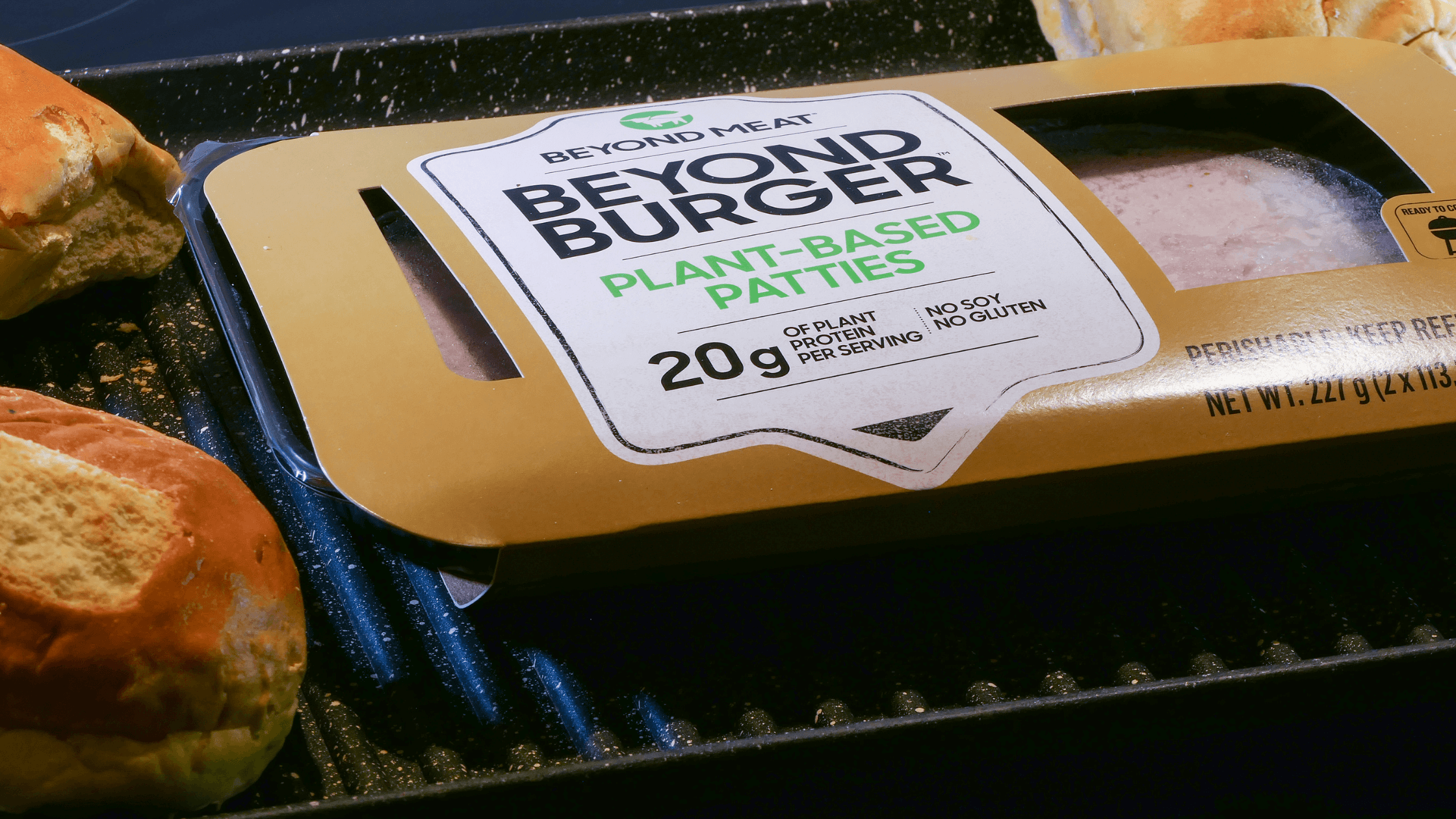

Costco has been great at keeping its customers sticky. That’s because its “paid membership” model grants access to wholesale prices for consumers.

That has made its 795 monster “warehouses” worldwide a hit with consumers. Nearly all of them are in North America but the company also has a decent presence in the UK, Japan and South Korea.

Its earnings per share (EPS) of US$3.13 comfortably beat consensus analyst expectations of US$2.85.

More impressively, same-store sales climbed 11.4% during the quarter – showing how important the retailer has been to the majority of Americans during the Covid-19 pandemic.

Slow but steady growth

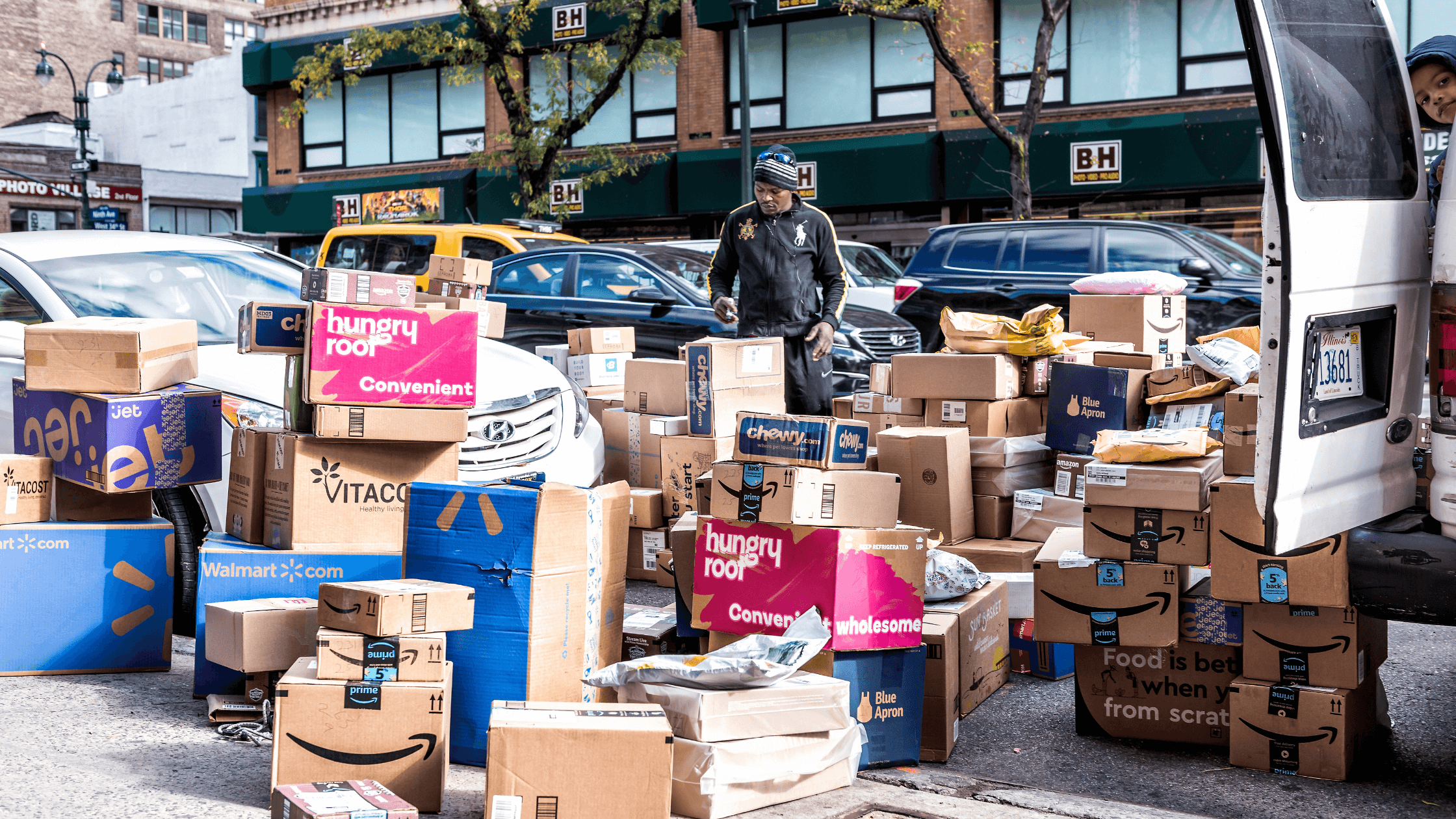

E-commerce revenue climbed a whopping 91.3% year-on-year. Allowing members to order online and pick up purchases in-store has become de rigueur for retailers of all stripes. Costco has been no exception.

The company continues to be an extraordinarily sound business, as its most recent 5.3% increase (to US$1.11 billion) in paid memberships attests to.

However, more recently Costco’s refusal so far to implement “curbside pickup” has been making headlines.

This has been rolled out by a wide range of retailers – particularly those focused on groceries such as Walmart Inc (NYSE: WMT) – where customers drive to the location, wait in their car and have the items brought to them. That’s all done without ever having to set foot in store.

So far, Costco hasn’t shown any interest in it given the logistical reshuffling of space required. For investors, though, it’s one trend to watch as consumers become accustomed to new ways of shopping in a post-pandemic world.

Disclaimer: ProsperUs Head of Content Tim Phillips owns shares of Costco Wholesale Corporation.

This material is categorised as non-independent for the purposes of CGS-CIMB Securities (Singapore) Pte. Ltd. and its affiliates (collectively “CGS-CIMB”) and therefore does not provide an impartial or objective assessment of the subject matter and does not constitute independent research. Consequently, this material has not been prepared in accordance with legal requirements designed to promote the independence of research. Therefore, this material is considered a marketing communication.

This material is general in nature and has been prepared for information purposes only. It is intended for circulation amongst CGS-CIMB’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material. The information and opinions in this material are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, derivative contracts, related investments or other financial instruments or any derivative instrument, or any rights pertaining thereto. CGS-CIMB have not, and will not accept any obligation to check or ensure the adequacy, accuracy, completeness, reliability or fairness of any information and opinion contained in this material. CGS-CIMB shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof.